Hi Friends,

I have been in the Market almost for a year and here I want to share my experience as well as my analysis of some past important event so it will help us to deal properly with upcoming important events.

One of the most important as well as unexpected event was "BREXIT". Before the polling day most of the market participants were considering there would not be Brexit. British people will go with EU, but unexpected thing happened and people voted to leave European Union. And we have seen a sudden drastic reaction appeared all over the stock markets and in currency markets. All stock markets, currency markets in all over the world, fell by about 10 percent and the same day recovered by half and after that even stock markets all over the World are making new high over high's.

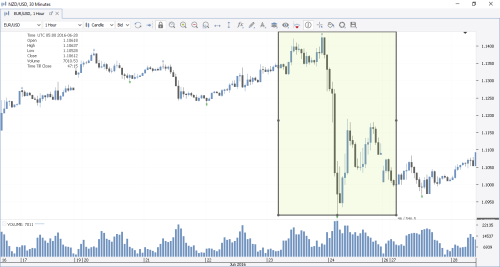

Below is the hourly chart of EUR/USD on 23rd June. Drastic reaction is visible as the counting of votes started. Then there itself we have seen a recovery by half and again a fall.

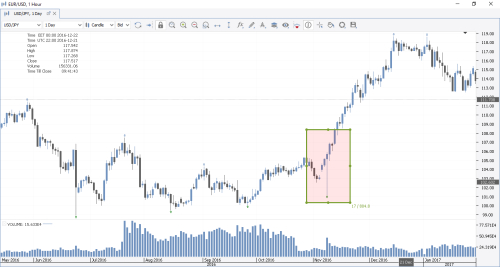

Below is the daily chart of EUR/USD. After fall of Brexit, almost within 2 month it has reached near same high as where it was before Brexit.

Reason was after the event finished various Central Banks came to the rescue of Markets and gave assurance that they will do everything to propitiate the bad effects of Brexit. So we have seen a recovery.

For our help there was interview on Dukascopy TV before the referendum and what way would Brexit can affect Eropean Union and United Kingdom . In this interview we can get idea about possible Brexit effects.

Now we will analyse US Presidential Elections. Market participants were expecting Hillary Clinton's win. But Donald Trump got elected. There was sudden fall in the prices of US Dollar as well as Stock Indices during the counting of votes. But after President elect gave a speech all the Markets recovered and US Dollar has touched new high's.

There was programme on Dukascopy Tv what would if Trump gets elected.

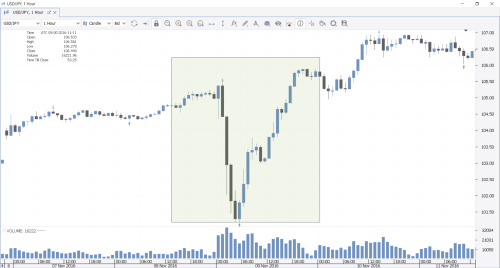

Below is the hourly chart of USD/JPY. We can see how USD/JPY fell by almost for more than 4% and then recovered and then kept on making new high after that.

On daily chart of USD/JPY we can see a daily rise of USD/JPY after 8th November and the analyst gave the conclusion that market participants now acknowledging that Donald Trump's economic policies are healthy for the Markets. And after we are experiencing new high's in Stock Markets as well as in the prices of US Dollar.

I think the market behaviour is not always right. Because why we need this fall to rise again and then keep growing. Real problem retail trader faces are whether to do trading on news days or be away and keep watching how the market reacts to the particular news and event. Because these days institutional trader and financial institutions use algorithmic trading. Where already a particular data feed has been given and the particular event occur like that then prices go up or if event occur opposite to the data feed they just simply change there position.

You all may ask why I am discussing all these things and what is the relation of all this past event with upcoming events.

Well we know there is Frech Presidential election on 7th of May and I want to make you prepare for that.

This time French Elections are more important than ever because two opposite Presidential candidates are in ring. Emmanuel Macron and Marine Le Pen. I will give you brief intro of these two candidates.

Emmanuel Macron

is Pro European Union as well as he pitches for the strong Euro reforms. He want to build trust between France and Germany and pave way for reforms in European Union and which will help to forge greater unity among 19 members European Union. He feels no other nation should think like Brexit so he, also wants to gave better opportunity to investor and want to pitch Paris as better investor option than London in United Kingdom.

Marine Le Pen

She has already made clear that if required reforms are not carried within EU she would hold a referendum like Brexit. She is against immigration policies and wants strong border protection for the France. She wants to reduce immigrants. She has been called as populist and against strong austerity measures.

Now the scenario is Market expecting Emmanuel Macron's win. As two candidates who failed to qualify for second round called their supporters vote for Emmanuel Macron. If Emmanuel Macron wins then all goes well. It will further support Euro growth. Already after first round of elections Euro rallied for almost 300 pips.

Marine Le Pen is viewed against open society and open policies of Europe. And if Marine Le Pen wins we can expect a drastic reaction in market. Euro weakening, Global indices may witness sharp fall and JPY as well as GOLD getting stronger.

Below interview gives us insight into France elections.