THE USA VS THE EUROZONE

14:50 20.02.2018

There are a lot of factors that affect currencies markets. They are divided into two groups: unpredictable and predictable events. The first group of unpredictable events includes political news and natural disasters. The second group, that we will consider today, covers economic indicators that are displayed in an economic calendar and released at the exact time.

These indicators show the economic growth and health, they cause exact monetary policy decisions of central banks. If traders know how these figures influence the economy and currency, they will know how to trade.

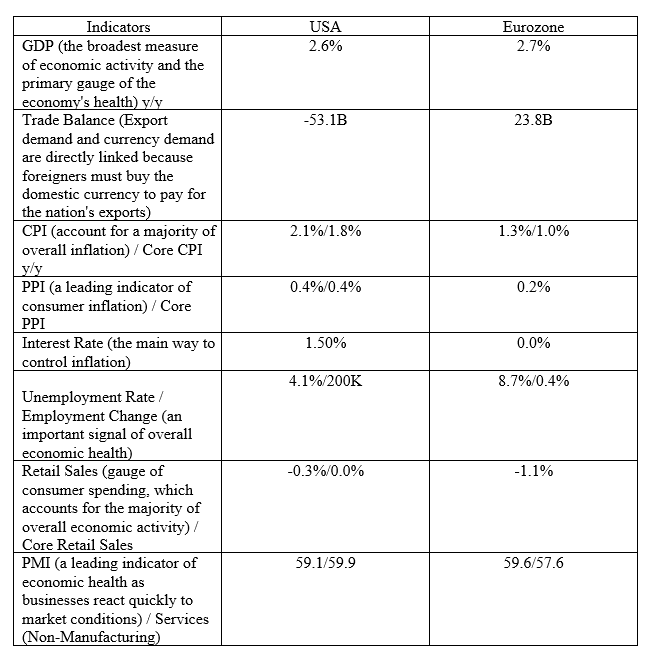

We offer you to compare the last data on the main indicators of the two world’s largest economies: American and European. Under the table, you will find an explanation.

Let’s start with GDP (Gross Domestic Product). As we can see from the table, the American and Eurozone GDPs are almost similar. It shows the stable growth of economies as GDP is the broadest indicator of the economic health. An important fact is when the GDP rises, the domestic currency’s rate grows.

Trade Balance. When deficit happens to the trade balance, it leads to the fall of the domestic currency. Comparing figures of the American and European trade balance, we see a deficit in American balance and profit in European. If you look at currency rates, you will see that the US dollar is depreciating now, when the euro remains firm. Although there are many other factors that influence the currencies, trade balance plays its part.

CPI (Consumer price index) and PPI (Product price index) are two of the most important indicators of a monetary policy. CPI estimates an inflation level. And according to this level, a central bank decides which monetary policy to apply. The normal level of inflation is 2%, so all banks aim to reach this figure. If the inflation above 2%, the same when it is much below 2%, it is bad for the currency, the domestic currency depreciates. When we compare the data of the US and the EU, we can see that the CPI data is bigger in the US, it means that inflation is higher there, that is why the Fed has already started tightening its policy and increasing the interest rate. It will positively affect the greenback. The Eurozone CPI is not so high, that is why as we know the ECB is not going to raise the interest rate in the close future. Now it is just tapering quantitative easing.

Central bank uses interest rates to control inflation in a country. When inflation is near 2%, a central bank starts to tighten its policy, rising interest rates. It positively affects a domestic currency. When a central bank slows down interest rates, inflation rises, so it is bad for domestic currency. If we look at rates, we can see that the EU has the lowest rate of 0.0%. Such low rate is not good for the euro. Here we can say that the US rate of 1.5% affects the US dollar more positively than 0.0% rate the euro.

The lower Unemployment rate data leads to currency’s growth. We can notice that unemployment is in 2 times lower in the US, so it shows the positive growth of the US economy.

The Eurozone does not release Core Retail Sales (Retail Sales excluding Autos), that is why you cannot find the second figure in the table. So let’s compare Retail Sales. When retail sales increase, a domestic currency may appreciate. According to RS figures, the US economy has better data, so consumer spending is higher in the US, the economy is growing faster, it is good for the US dollar. However, both figures are negative, that is a bad sign for an economic growth.

The last but not least indicator is PMI. It is a survey of manufacturing and service industries that shows the economic health. Looking at the data, we can say that figures are almost similar in both economies. Moreover, figures above 50.0 mean industry expansion, so we can say about expansion in manufacturing and services in America and Europe.

Making a conclusion, we can say that the US economy looks better than the European one in more indicators. You can think that despite good indicators, the greenback has been falling for a long time when the euro is steady. But you should not forget about other factors that affect currency rates: positive indicators of other currencies, political issues, and traders’ mood. Tightening of the Fed’s monetary policy can lead to the rise of the US dollar soon. Positive economic indicators support this trend. At the same time, although now the European economy is failing against the American one, experts see a potential. Tapering of quantitative easing may lead to the growth of the inflation that will let increase the interest rate and will support the euro in the future. Good figures of GDP, trade balance and PMI will support the Eurozone’s economy.

More:

https://goo.gl/As9zmC