Before you enter into a position, you need to know – beforehand – when you are

going to exit the market. A trader is not going to hold onto a position indefinitely,that’s for sure. Knowing the time frame of how long you wish to hold onto your open position will determine your exit points and prices. If you choose to hold a position for, say, a week, your profit objective would naturally be higher than if you were to hold it for a few hours because you would expect the price to move further,given the longer period of time.

This is a personal decision which has to be made by the trader,depending on his or

her risk tolerance level, lifestyle desired, and the amount of time to be dedicated to analyzing the market.

There are mainly four different types of trading time frames:

1. scalping

2. day trading

3. swing trading

4. position trading

These are explained below

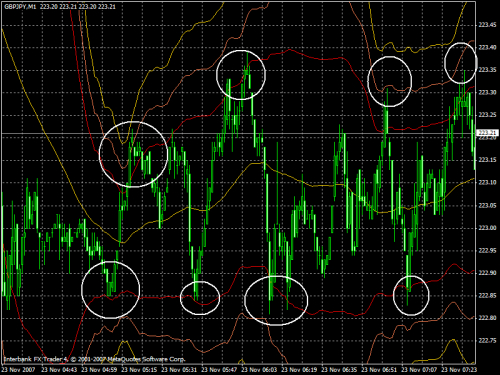

1. ScalpingThis is the shortest time frame in trading; it exploits small changes in currency prices. It describes the ultra-rapid action of opening and closing of a position within a few seconds or minutes, with the aim of stealing a few pips from each trade. The profit of the winning trade is small, while the number of such winning trades should be big enough so that these small profits can add up to a decent amount.

Scalpers usually need to have access to the tightest spreads and fastest connection speeds possible, in order to carry out this bullet-speed trading with the tiny profits.

They tend to do this many times a day so as to accumulate the little profits that are harvested.

Losses must be limited such that one large loss does not wipe out the profits gained from many winning trades.

Many forex market makers discourage this type of trading as they find it difficult

to cover the opposite side of the transactions, given the fast speed and numerous orders entered into their systems.

2. Day trading

2. Day tradingDay trading is one of the more popular types of trading, whereby traders open and close positions within a day. They also do not hold their positions overnight because of the added risk of not knowing if prices would change dramatically while they sleep. The holding period of their trades may range from minutes to hours.

Day trading relies heavily on intraday momentum to bring the current price to the desired price level in one direction. Day traders are looking out for signs that a currency pair has a high probability of moving in a particular direction, going from point X to point Y, within a day regardless of whether the price is moving in a trend or range.

Day traders tend to wait for good trading opportunities, instead of trading frantically like scalpers tend to do. This style of trading involves intense concentration from the trader as positions must be closely monitored on the price

3. Swing tradingSwing traders hold their positions for a few days, but seldom more than a week.

Identifying and riding on trends early is the central objective of this trading style, and the profit objective tends to be set higher than that of day trading since the swing trader is expecting that by holding out for a few days, there is a better chance of capturing a larger price move. Unlike the day trader, the swing trader has to endure overnight risk.

As swing trading requires much less minute-to-minute monitoring of the market, this type of trading is generally preferred by people who hold day jobs.

My opinion is that swing traders must still keep up-to-date with the latest fundamental and technical changes in the market, even when they are not monitoring the market all the time.

4. Position tradingPosition trading spans the longest period of time, and refers to traders holding their position for weeks or even moonths. Position traders seek to identify and trade currency pairs that signal that a medium to long term trend is playing out – but will take more than a few days to play out. Their positions are usually closed before the trend runs out of power. This trading time frame is the least time-consuming one among all the different ones, as there is not much need for intensive monitoring.

Many position traders place a trailing stop which automatically closes their position if the price retraces past a particular point.