Because what distinguishes the successful trader from the loser is a simple mistakes can cause large losses instead of reaping the gains, In this regard, we will highlight a set of rules and steps that will help you to accurately identify your transactions towards gains and away from any potential losses.

Step 1: Trading strategy is a key factor that makes you a winner in the currency marketSome believe that being listed as a winner in the foreign exchange market requires the maximum number of winning points, but in fact the situation is not so. Of course, winning points is important, but it is not sufficient to sustain this profit. To become a successful trader you must manage a strong capital and control your mental state so that your mood does not affect you and make you make the wrong decisions.

One of the most important steps to get into the category of gainers in the financial markets is to follow a specific trading strategy. You should not be random and have clear and specific conditions to enter into the deal. You should test the strategy on a demo account first before applying it to the real account. One of the advantages of this is to know the best pairs of currencies that achieve the best profits and any time frame is the best and that meets the conditions of entry and most transactions reach the goal already.

You should also take into account a specific strategy that helps you to self-discipline and not interfere with your psychological state of trading and that will lead you to losses, but should make us more strategic and distract us as traders of the state of anxiety that we get once the deal enters until you reach the goal. This concern prompts some to get out early in the deal or move the target or keep the stop.

It is preferable to test the results of the strategy retroactively to determine the sustainability of the success of this strategy and make appropriate adjustments to it to help you achieve profits. In this regard, you should not forget to review important events and data that will affect the movements of most major currencies. Economic factors because they affect your trading strategy.

Step 2: Determine the entry level, exit level and goal before entering the deal

This step is one of the most important and successful trading steps, Setting the direction of your deal before entering is a key step towards a successful deal, And helps you in this technical analysis or economic analysis, on the other hand, leaving your transactions outstanding without the existence of clear levels is only a shortcut to the loss. Once the levels of entry and exit are determined, review the profit-to-risk ratio to determine whether the transaction is suitable for capital management or is indispensable.

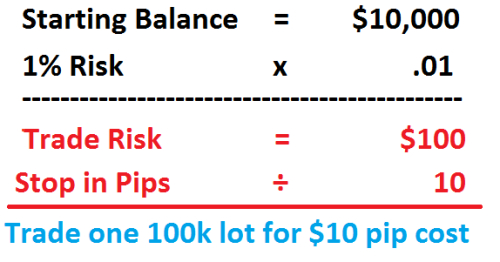

Step 3: Determine the size of the transaction

This skill is also one of the most important skills of the successful trader and without them may be entering deals either larger or smaller than supposed, Which may end up with you losing capital or making less than what you deserve. Many people think that novice traders must adhere to a risk ratio of not more than 1% until they can better assess the risk and gradually increase it. Coordinating that step with the first step will increase the chances of entering into better and more successful deals.

Step 4: Follow up the dealOf course, your role will not end once the deal is entered and the target and the exit point are determined, your role remains active until the deal is closed. Regardless of whether you are a daily trader, long-term trader or trader, the deal you enter remains worthy of follow-up. And do not forget that the price variables may move quickly so you will have to interact with them if necessary. With practice you will gain the necessary experience that enables you to modify your deals to get better results.

In the end, the goal of a successful trader is not limited to maximizing profit but getting successful deals and taking advantage of market opportunities to your advantage. Avoiding possible mistakes and their consequences are also a success skill. Try to focus on following the right methods and choosing what suits your style and trading strategy to get the best deals possible and with high quality.