The concept of profiting from traders who are trapped in a losing position is simple.

These traders, by virtue of being on the wrong side of the market, can help propel your trade when they hit the exits.

Wyckoff is actually the person who brought this idea of using upthrusts and springs to capitalize on traders who are on the wrong side of the market.

It is simply using a common price action trading setup and wrong footed traders to aid you in obtaining high probability trading setups.

I want to show you how you can profit from these traders.

Issues Of Traders Who Are TrappedThe fear and panic by those who enter a trade only to find the market going against them can cause a sudden burst of price movement.

This movement in price is caused by these traders exiting their positions and creating order flow in the opposite direction from which they entered the trade.

Whenever you look at the high of a green candle, picture someone hitting their buy button and entering the trade. Flash forward to the next candle being a red momentum candle and that trader who bought the high, is trapped.

To exit, they have to sell.

Now imagine many traders or many contracts being sold as these traders exit.

That is what we want to jump on.

Setups Where Traders May Be TrappedI want to show two trading setups that are designed to capitalize on the plight of these traders and take advantage of their mistakes. We’ve all been there and know what it’s like to find ourselves on the wrong side of the colored candles.

Now, let’s find a way that we can profit from those that find themselves in the same position.

These concepts apply to both long and short positions.

Failure Tests Of High/LowsSome will call these false breakouts but what is usually happening is the market is probing levels above certain areas for some sort of market action. These probes are designed to grab stops above key levels as well as entice buyers or sellers to jump on the breakout. They are also used to gauge interest at prices they are testing.

These are called failure tests or using the term the real inventor of this type of trading (Wyckoff) described it, upthrusts.

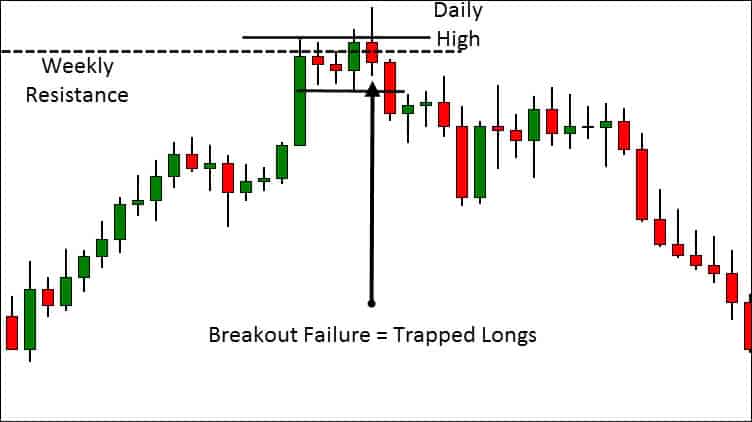

This is a daily chart and I have extended a weekly resistance line (since 2013) over to the displayed chart position.

Price is consolidating around the zone and this can often indicate a potential for a move in the same direction. I personally look for strong pushes and then price to consolidate at the highs of the move. Often times this can result in a further move up.

But here, context is key. Many traders take too small a view of the market and in doing so, miss out on important information.

This is not a short-term price resistance zone.

It goes back over two years, it’s a weekly zone, and the dashed line is not the top end of the zone. It is from a consolidation of price just under the extreme high of the zone.

Traders see the large green candle, the consolidation, probes, and finally a strong push up. Remember, that failure candle was actually a strong green candle at one point.

Traders pile into the long side and that high of the reversal candle runs right into the extreme high of the zone!

On the same daily candle, price falls back into the consolidation zone and those long are trapped on the wrong side of the market.

They must exit.

The next day, the red candle tells the story of all those traders that ended up being trapped, exiting and new shorts entering the market.

How To Play This Move?Once you have noted the reversal candle, you can enter at the break of the low or go short when price revisits inside the consolidation area.

Stop placement is simply above the extreme of the candle. If this is a true failure, we don’t expect the price to exceed that high.

We also don’t expect the price to stay in the consolidation area. We want to see strong movement after those that are stuck on the wrong side, exit the trade.

Failure to see price move in your favor soon after entry, you can use the “3-period rule” to exit your trade.

3 Period Rule: If the price does not do what you expected within 3 bars/candles after entry, exit the position.

Trapped Pullback TradersMarkets move in waves with impulsive and corrective moves. A very popular trading method is trading the corrective move and entering a trade in the direction of the trend once the corrective move signals completion.

The issue is that many traders are impatient and don’t want to risk not being in the move.

So they enter trades too early at the first sign of completion. When stopped out, they still don’t want to miss the move so they re-enter.

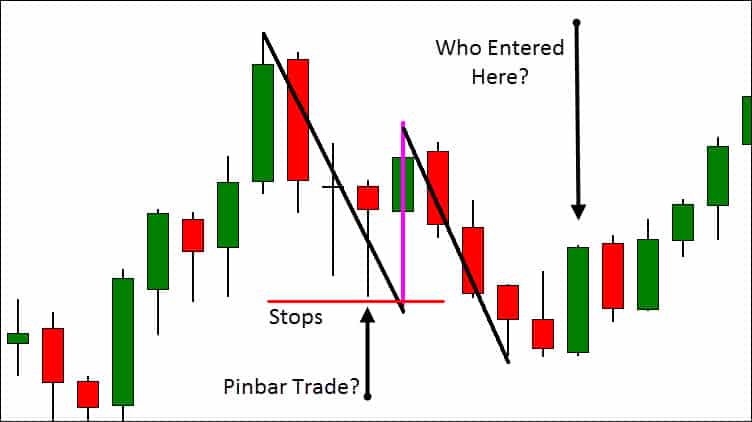

Complex pullbacks are a little tricky in that they can be hiding inside a higher time frame structure. What may appear to be a simple pullback will actually be a two-legged (complex) pullback on a lower time frame.

Again, this is simply how the markets move and nobody invented this concept. If you are a trader and you have to exit a losing position, when would you do it? It’s common sense.

e had what appeared to be simple pullbacks on this time frame. Remember, simple pullbacks can be complex pullbacks on smaller time frames. Price advanced off the simple but when this complex completed, the price went on an extended up move.

The first black line indicates the first leg of this pullback and the pin bar looks like it could indicate a resumption of the up trend. Traders enter and place their stop below the candle.

But You Are Looking For A Complex Pullback And You Sit On Your Hands.Price advances then turns around and turns the longs into traders who are trapped short and takes out stops. This could also entice short players who will end up being trapped if/when price turns back in the direction of the trend.

Seeing that large green momentum candle, what could be taking place?* Traders playing complex corrections take the long

* Traders who were in a losing position who exited longs earlier, re-enter

* Break out traders who got trapped shorting the market exit their position

Entering these types of trades is not always straightforward and neither is the stop placement.

1 You could drill down to a lower time frame and look for a pattern such as a short breakout failure on that chart.

2 You could buy stop a break of the highs once price breaches the low of the first correction and scale buy stop down until invalid.

3 Use a momentum indicator turn such as Stochastic.

Stops can be placed a distance from the low of the correction but not right under the pivot. You can still have price retest the area and execute the test that was mentioned earlier thereby taking out your stop.

Power Of Desperate TradersIt’s very hard to see your position on the wrong side of the market and the execution of your stop not only saves your account, but feed the account of others who understand how those who are trapped in a losing position are going to react.

It’s only logic to think that a trader in a losing position will exit at moment the paper losses evaporate and they are able to exit at or close to break-even.

Standard technical analysis always tells traders to place stops around the pivot areas or just above support/resistance in a range. How can you tell traders do that?

Look around your charts and on every time frame, you will see price enter a zone beyond the traditional stop zones and suddenly reverse.

Being on the right side of those moves can propel your positions into profit very quickly. The key is to see where traders may be on the wrong side of the market and get yourself positioned to take advantage of them when they have to execute.