IntroductionIdentifying patterns in forex trading, forex binary options trading or touch binaries can be a game changer, resulting in huge success. Pullbacks and throwbacks are one of the man patterns that traders could make use of, especially in binary options trading.

This article discusses the definition of pullbacks and throwbacks, their differences, how to spot them and some practical information for a binary options trade.

What is pullback and throwback?In general terms we can define the terms pullback and throwback as the return of the price to the predefined line of support or resistance, which was already broken, following which there is a classic example of support and resistance role switch.

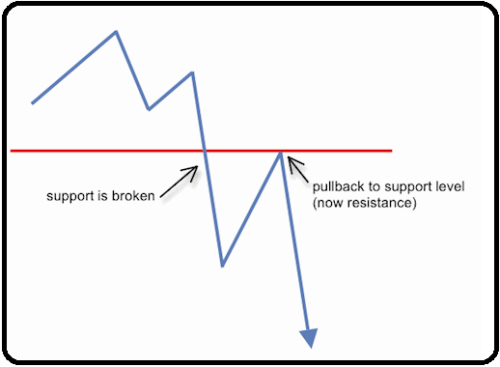

* Pullback

In a pullback the price breaks the line of support from the top, for a short moment, returns back and transforms support into resistance from which it reverses. A pullback is also referred to a as retracement or a consolidation. Graphically it can be represented by Fig 1 Below.

Fig 1: Pullback illustration

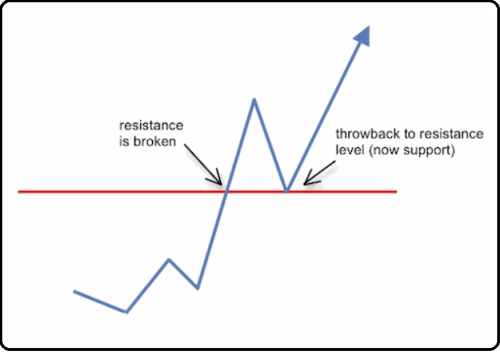

* Throwback

A throwback is the opposite of a pullback. It occurs when the price breaks the line of resistance from the bottom, return and creates support from the former resistance. A throwback pattern will show a price moving higher through its resistance but then retracting towards the resistance line.

Fig 2: Throwback illustration

Why the market pulls and throwsScanning through the old charts across a varied time frames it is evident that pullbacks and throwbacks are a common event. One of the major reasons for this occurrence is the presence of limit orders around the support and resistance levels. When the price breaks through an area of support or resistance, a bunch of limit orders on the other side of that key level get hit and there is a chance that the price will be knocked back, towards the key level. As traders we need to be mindful of where we place our stop losses on a breakout trade.

Practical examples of a pullback / throwback

Practical examples of a pullback / throwbackIn trading the use of Fibonacci lines, or with various lines of support and resistance, which can be drawn either by us or by an indicator can be used to spot a pullback or throwback situation.

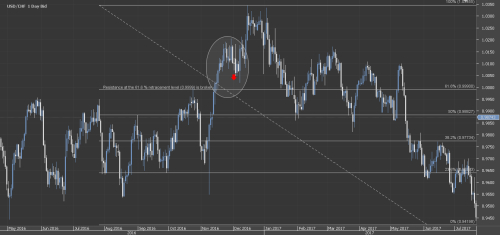

Fig 3: Practical Illustration of a throw back.

The illustration in fig 3 above is for the USDCHF on a 1 day time frame. The resistance level is a 1 and corresponds to the 61.6% retracement level using the Fibonacci retracement levels. Once the resistance is broken the price moves higher, peaks at 1.02 and then bounces back to the 1 level, but this time finding a strong support before resuming the upward trajectory.

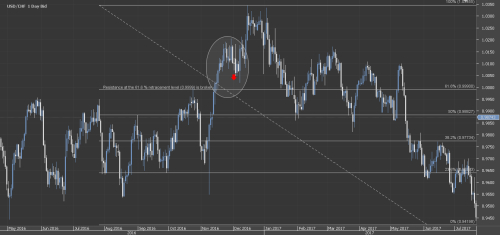

Fig 4: Practical Illustration of a pullback

Using the same chart as in fig 3, a throwback situation is illustrated. This time the support level is located at the 38.2% retracement level and once the position is broken a couple of pullback to the former support now resistance can be spotted.

ConclusionSupport and resistance levels play an integral part in the trading of forex. It is of paramount importance that the trader be vigilant whenever the price approaches these levels. However once broken, a support may turn to resistance or vice versa priming the pair for a pullback or throwback.