1. Abstract:There are a lot of information out there about pattern formations on Forex Market, but today I will talk about some patterns that are not very common in price action.

These are Cypher, Gartley, Butterfly, Shark, Bat. Also, the list is quite a little big.

I was working the last three months on this, leaving my well know process of trading a little bit alone.

And I was found some interesting situations about this kind of configurations because each pattern has specifics setups or rules.

Also, each pattern has different quality and profit win ratio.

For those who like to research and try new ways to improve your results, keep reading this maybe is an opportunity to start your own research.

2. Development:

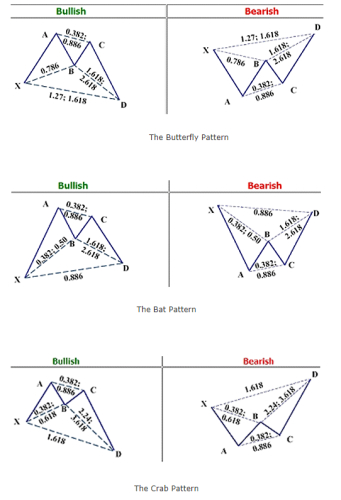

2.1 The basis:The chart below shows us the basic about only three patterns.

As you can see seems to be very mathematician and yes, it is.

A pattern needs to be complete to be valid, and we say that all patterns are complete when it reaches a "D" point.

To get one you need five points: X, A, B, C, D.

So, the easy part is to trade it when on any currency or stock market is found.

I will tell you the basis for entry and stop loss, also a suggested entry variation.

The hard part is to found it because you need to work on making a lot of calculations to fit specific ratios.

Any time frame is valid, but the higher the time frame is the higher the potential profit will be.

But I found that from one hour chart, four hours and one day chart is the most used.

To start this you need a Fibonacci tool, that means you need to be very good using this and support/resistance levels.

Also, there are quite long solutions to get involved in this kind of setups easy.

That means scripts plotted on MT4 charts to get alerts on any kind of patterns.

Some of them are a pay subscription and others are free, I am testing both of them now.

Maybe the next coming months will create a post talking about this.

2.2 Trade the pattern:When you got a pattern complete, the basic is to put pending orders above or below the "D" point.

The basic stop loss needs to be placed between 10 and 25 pips above/below of "D" point.

If you want to enter in a bullish pattern, your entry must be above of "D" point.

If you want to enter in a bearish pattern, your entry must be below of "D" point.

On my own research, I was found that the best entry, to avoid a failure pattern is to do it at 23.6% or 38% of Fibonacci Levels.

And 113% or 127% Fibonacci levels of the extension.

That means to take the swing low / high with the "D" point and create an entry using these levels. Also, can serve as a limit to the stop loss.

2.3 Current patterns:The charts below show possible patterns to get involved.

The black box means the suggested entry, the red box means the stop loss and the green box is the projected profit targets.

BEARISH SHARK ON NZD/USD: BEARISH BUTTERFLY ON GBP/CHF

BEARISH BUTTERFLY ON GBP/CHF BEARISH BAT ON NZD/JPY

BEARISH BAT ON NZD/JPY 2.4 List of suggested patterns for this week to the end of the month:

2.4 List of suggested patterns for this week to the end of the month:

I am giving to you the current list of pattern formation that was found today at 00:30 GTM(0)

Most of the patterns are potential winners buy that means not 100% effective if you decide to take it do it but check it first.

Also, make your own validations and calculations about entry and exit points.

Chart: Daily, pattern time: 17/July/2017 01:30 GTM(0)

Pair, direction, name, completition point valueUSD/CAD, BULLISH, CYPHER, D = 1.264

EUR/JPY, BEARISH, GARTLEY, D = 130.2

GBP/CHF, BEARISH, BUTTERFLY, D = 1.2635

AUD/CHF, BEARISH, GARTLEY, D = 0.754

EUR/CAD, BULLISH, GARTLEY, D = 1.449

CAD/CHF, BEARISH, SHARK, D = 0.7625

NZD/JPY, BEARISH, BAT, D = 0.8265

NZD/USD, BEARISH, SHARK, 0.735

3. Conclusions:Trade patterns on forex market are very profitable but are necessary to have a proper entry, exit technique.

To do this you need to validate the actual conditions of each pattern and fit it with the use of extra tools as support and resistance levels. That is not only pivot points, more like to see where is the zone in the chart where the price action has been bounced multiple times in the past.

The next week I will create a post with the respective analysis of the patterns provided here.

Good trading.