In a trading period of two years, from 2014 to 2016, I've tested a sentiment trading indicators. One was live traded, the Options Sentiment Indicator (OSI), and one was backtested during the same period. This other indicator was able to generate buy and sell signals on the Euro every single trading day, the sentiment proxy of the universe of texts courtesy of SMA.

What was interesting is in theory the OSI, a proprietary indicator, acted as a noise trading indicator, able to profit in times of non-linearity, or during see-saw trends in the market for the Euro. And, the sentiment proxy from SMA, was able to capture a greater risk-reward ratio then a non-directional Euro from 2014 to 2016.

Here's the EUR/USD chart for the corresponding time period of the study:

TABLE RESULTS

TABLE RESULTSNow, to introduce the signal detection theory, it's important to note that this perception science has everything to do with signals presented, and signal responses. Similar to getting an eye exam, where the optometrist presents a series of signals on an x-y coordinate, the signal detection theory tests whether there were matching responses (a "hit"), or a failure to recognize the signal (a "miss"). Whats more, this perception science is tests for false positives and correct rejections.

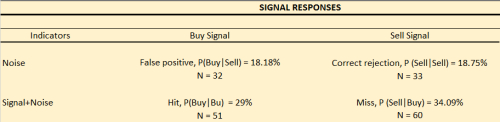

In this test, the main signal is the indicator generated daily from SMA, the sentiment proxy of the Euro. And the signal response is the proprietary OSI, the noise trading indicator. Here are the tabulated results of the study:

Note, the signals produced from the Noise indicator for the test period totaled 176, and the signals from the daily sentiment proxy totaled 477. So the total N number of trades in this table is 176, differentiating the Noise responses and the Signal+Noise responses.

SIGNAL % RETURNSThe results show that 29% of the trades were hits. In this case, where both the Noise and Signal indicators produced Buy signals. And, 34% of the trades were misses, if the Noise indicator generated a Sell signal when the Signal was a Buy.

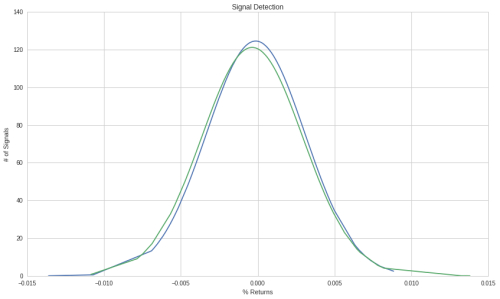

Here are the resulting means and distributions of the signals:

The resulting mean for the Noise indicator was equal to -0.014%, and mean for the Signal was -0.036%, where a random sample of 176 was taken from the sample population of n=476 trades.

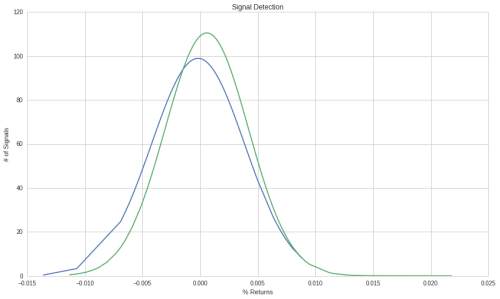

Here are the actual results from the study, tested from 5/2014 to 5/2016:

You'll notice the distribution for the Signal, the green plot, is taller due to a greater number of trades represented, and the average is further to the right, equal to 0.057%.

With that said, it's also important to note that the table above is focused on the signal and signal responses only. The distribution plots are focused on the resulting signal returns for the corresponding Signal and Noise indicators. This study was an adaptation of Signal Detection Theory, and has some limitations to its application. However, the research study had been performed with relative success, testing the proprietary indicator OSI as a noise signal. The sentiment proxy via SMA was also tested in the research study, able to produce greater risk-adjusted returns for the period where the Euro was non-directional.