One of the most common questions of new traders is: ‘which is better: Technical or fundamental analysis?’

While technical analysis can be performed on any chart, fundamental analysis, or the study of the actual components of the economy that represents a currency, can be quite a bit more subjective.

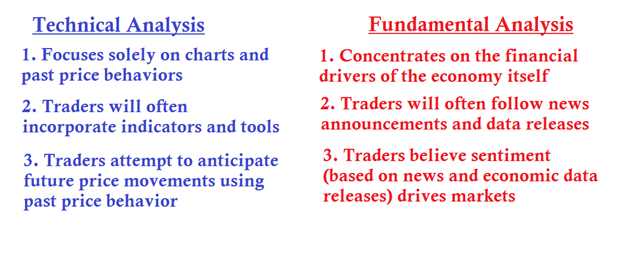

If this were a perfect world, we may have a direct and accurate answer to our new trader’s question. Unfortunately reality prevents it from being so. The table will walk through some of the differences of these two breeds of analysis:

Rare is the FX Trader that successfully traverses the terrains of markets with only ONE of these forms of analysis. Most traders have some elements of each comfortably in their repertoire. In this article, we are going to show you how you can do this.

Technicals Help to See What HAS HappenedTechnical analysis has a very large role in the FX Market, perhaps even moreso than stocks or futures markets from where this analysis was popularized.

The art of Technical Analysis revolves around analyzing a chart – and strategizing an approach for trading it. There are numerous ways of doing this, and many traders like to include indicators, price action, and a whole flurry of other analytical systems for designing ways of placing trades in the present based on price movements of the past. The picture below shows just some of what traders are looking for in regards to Technical Analysis:

In the above graphic, there are four different mannerisms of support and resistance identified (the same 4 we covered in our How to Build a Strategy series), along with trend identification, and indicators to assist with the risk management approach (‘Average True Range in Pips’ custom indicator). All of these can be associated into the technical setup while arranging a trading plan.

We go over these technical components in the 5 parts of our How to Build a Strategy series. In each of the five component articles in the series, we go into much more depth around that specific subject matter. This is all with the goal of helping traders build an approach based on what has happened in the past with the prices that the asset has actually traded at previously.

This analysis can provide us with a great deal of information, such as being able to read the sentiment that may be on chart, or any biases that may exist. What it will not tell us, however, is the one thing that we most want to know – and that is what will happen next with regards to price. For that, we will need to introduce fundamental analysis into the picture.

Fundamentals Help Shape Future Price MovementsAs news releases and additional data filters into the market, traders will accordingly bid prices higher or lower to account for this new information. News releases can often function as a 'motivator' to a market, promulgating future price movements. As such, this leads many to the conclusion that:

News releases can bring considerable volatility into the market, and trading based on fundamentals doesn’t necessarily mean that you need to trade the news.

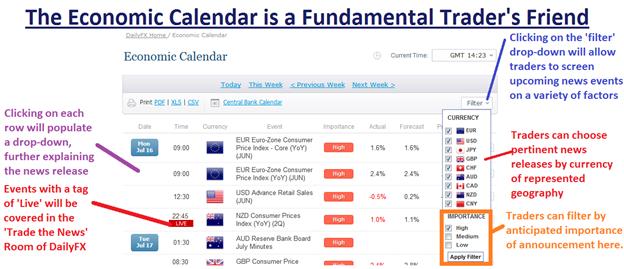

As a matter of fact, traders can use what they have already built in regards to Technical Analysis to plan an approach around news events. The picture below will explain further:

The primary takeaway in regards to fundamental analysis is that large movements can emanate from each of these releases. And just like we looked at in part 5 of our How to Build a Strategy Series (Risk Management), traders need to know that there is a very real prospect of being wrong, and getting stopped out of the trade. So, for all strategies – it is advisable to trade with a stop so that one trade doesn’t end up doing irreparable damage to your trading career.

Combining Technicals with FundamentalsJust as we had led off with in our How to Build a Strategy series, traders are often benefited by first identifying the market condition with which they are looking to trade.

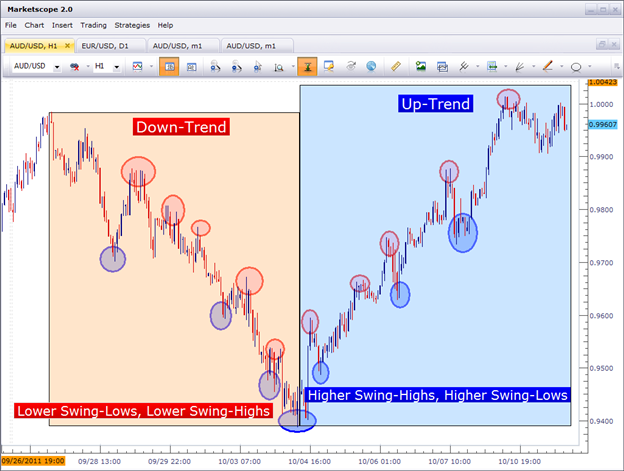

For traders looking to trade trends, they want to see a ‘bias’ in the market. This can be done with Price Action in a very concise manner: For up-trends, this can be a series of higher-highs, and higher-lows; and for down-trends, a series of lower-lows and lower highs. The chart below will illustrate in more detail:

When traders see these types of trends, they are seeing a bias in the sentiment of that market. During a down-trend, that bias is lower – and during an up-trend, the bias is higher. And during these situations, it’s not just enough to buy or sell and hope that we are on the right side of the trade.

Traders should look to buy up-trends cheaply, with price at support; or look to sell down-trends expensive when price is near resistance. Traders can use any mechanism of identifying support or resistance to assist with this process; but is of the upmost importance that traders realize that trends can reverse at any time (much like the above graphic shows a strong down-trend turning into a strong up-trend). As such, risk management should still be used even if it appears that there is a clear bias in the market.

To integrate fundamentals into this approach, the trader can look at the economic calendar as an opportunity to ‘buy cheaply, and sell expensive.’ The trader is looking to take advantage of an overreaction to a news announcement that allows for an opportunity to enter in a longer-term biased market. The picture below will illustrate in more detail:

In the words of our own Jamie Saettele, traders should look to ‘react to the reaction,’ of news releases; and traders taking the aforementioned stance towards trends going into fundamental data releases are doing just that.

Ranges and BreakoutsFor traders looking to trade ranges and breakouts, the integration of fundamentals and technicals will be slightly different since no bias is being exhibited going into news and data releases.

However, the motive is much the same: Traders anticipate volatility coming from the news release, and they look to use this to their advantage.

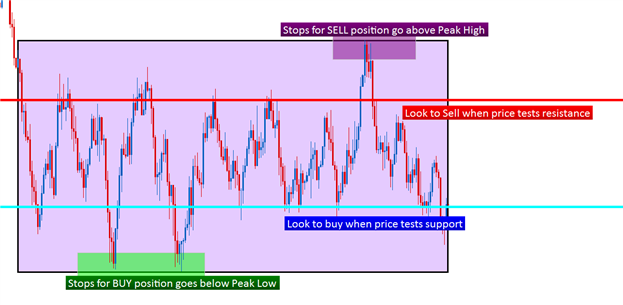

While range traders should remain cautious when going into news releases (since additional volatility could pierce support and/or resistance with which they are using to set their stops), they can still look to take advantage of overreactions to news. The picture below will illustrate with more detail:

Traders in these situations would want to wait for news or data to cause price to go to support and/or resistance – and once a test of either of these levels are put in – could look to buy or sell accordingly.

Once again, the trader would look to ‘react to the reaction,’ of the news release – using their already prescribed technical setup of buying at support, and selling at resistance.

For traders looking to trade breakouts, they can, once again, look to use the reaction to the news event in the center of their trading strategy.

Traders can look to trade breakouts with any of the prescribed mechanisms of support and resistance, with the anticipation that news releases could bring in the wanted volatility to a) trigger into the trade b) move the trade closer to the trader’s profit target.