Japanese candlesticks are a popular charting technique used by many traders. Today, we are looking at the shooting star reversal pattern which is a popular Japanese candlestick formation and how to apply it towards the FX market.

What Does a Shooting Star Look Like?

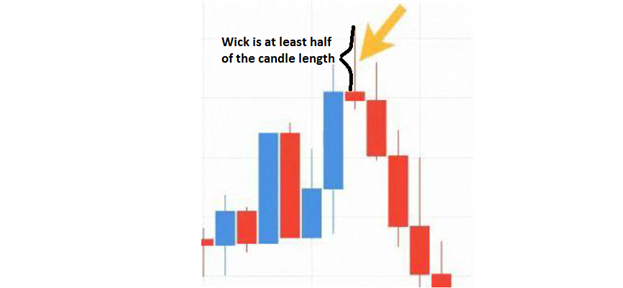

(the shooting star is the red candle at the high point above)

A shooting star formation is a bearish reversal pattern that consists of just one candle. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a long wick to the upside. The long wick should take up at least half of the total length of the candle.

Additionally, the closing price should be lower than the opening price creating a red candle. As you can see, this creates an overall bearish structure because prices were unable to sustain their higher trade.

Trading the Shooting StarTrading this reversal pattern is fairly simple. First, the implication is for lower prices therefore we want to look for entries to short. Since the prices were previously rejected at the high of the shooting star, we will establish our stop loss about 10-20 pips above the high of the said candlestick.

The entry can take place in a couple of manners. First, a trader could simply enter on the open of the next candle. Or, if the trader was more conservative and wanted to capture a better risk-to-reward ratio, we can trade a retest of the wick.

Retests of the wick tend to occur when the wick is longer than normal. Oftentimes, prices will come back and retrace upward a portion of the long wick. A trader recognizing this might wait to enter around the middle of the wick rather than enter immediately after the shooting star candle forms. This means the trader is entering a short trade at a higher price and with a tighter stop loss reducing risk.

Regardless of the entry mechanism, the stop loss will remain the same which is about 10-20 pips above the shooting star candle.

Regarding profit targets, we teach in our courses to take profit at least twice the distance as your stop loss. So if your stop loss is about 90 pips, then look for at least 180 pips of profit potential. This means we are establishing a 1-to-2 risk-to-reward ratio which falls in line with the Traits of Successful Traders research.

Trading the AUDJPY Shooting StarOn Friday, November 2, the AUDJPY produced a shooting star reversal pattern on the daily chart.

What makes this set up appealing is that it forms near 2 other levels of horizontal resistance.

1. Purple horizontal line which coincides with the previous high on August 20, 2012 and October 25, 2012. This resistance line is near 83.60.

2. The 61.8% retracement level of the March 19, 2012 to June 1, 2012 down trend crosses near 83.23. (blue horizontal line)

Therefore, a strong resistance zone is created. As prices approached this resistance zone, the buyers stopped buying and the sellers started selling which left a shooting star candle pattern in its wake.

Since the AUDJPY has been trading in a range between 79.70 and 83.50, consider an entry to short near the top of the range near 83.15 with a stop loss just above the shooting star high near 84.05.

We’ll look to take profits near the bottom of the range at 80.15. This means we are risking 90 pips for a potential reward of 300 pips. This yields a 1-to-3 risk to reward ratio.