Inside day is a widely followed trading strategy for securities with range-bound price movements. It suits forex trading in particular due to the nature of price swings observed in forex markets. This article explains inside day breakout trading, what forms this pattern, entry/exit points and what to consider when trying this strategy.

Meaning of Inside DayThe inside day is a candlestick pattern made up of intraday price ranges relating to Open, High, Low and Close (OHLC) prices. When today’s OHLC price band lies completely “inside” the limits of previous day’s OHLC price band, that's an inside day pattern, also known as inside day bar. Note also that the previous day's bar can be known as “mother bar” and today’s bar is referred to as “inside bar”. Simply put, today’s highest price should be lower than yesterday's highest price, and today’s lowest price should be higher than yesterday's lowest price.

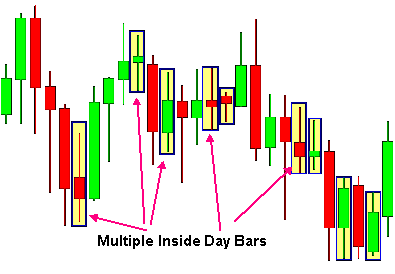

It should look like this:High liquidity due to large-scale trading (generally by big institutional traders), is mandatory for inside day pattern formation. Effectively, inside day indicates a state of indecision in the overall market i.e. no movement in either direction beyond yesterday’s range. There can be multiple inside day patterns day after day, indicating a continuous reduction in volatility and thus the increasing possibility of a breakout.

Why and how do inside day patterns get formed?

Why and how do inside day patterns get formed?Understanding the reasons behind the formation of such patterns can help traders spot subsequent symptoms. Here are the key reasons why inside day patterns form:

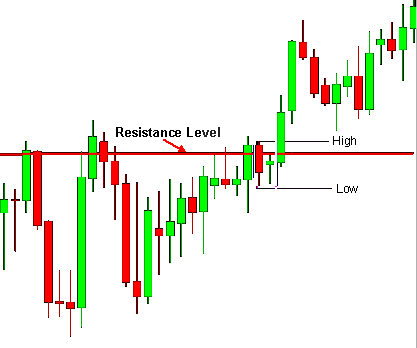

1) Trend Reversals – The probability of inside day pattern formation is high when an asset trades around support and resistance levels. Around resistance levels, sellers start taking short positions and buyers start profit booking for their long positions. The opposite happens for support levels, when buyers start building long positions and sellers cover their short positions. In both cases, trading occurs in a tighter price range as a trend reversal proceeds from one day to the next, creating inside day patterns.

2) Breakouts – Before an asset price breaks any long perceived support or resistance level, a period of consolidation is observed. During this time, the price remains in tight range, touching support/resistance levels a few times, and then breaks out steeply in one direction. In this period just prior to breakout, buyers and sellers build their positions, leading to inside day patterns.

3) Consolidation during up and down trends – During strong up or down trends, several inside day patterns develop sporadically. This happens as traders either book profits or add to profitable positions. Losers attempt to cut losses or average out and new entrants advance, expecting continued momentum. The net result is a lot of range-bound trading activity, leading to the formation of an inside day pattern.

4) Low liquidity periods – Even the most volatile and liquid stocks enter a stagnant phase of low market activity caused by market sentiment, the macroeconomic situation, less activity by institutional traders or a holiday season. Such periods also give way to inside day pattern formation.

How to trade inside day patternInside day patterns often arise, but traders should note that not all inside day patterns are profitable. Heed the important points below:

* The frequency of trading inside bar patterns varies according to the trader’s preference. It can be used an hourly, daily or weekly basis. For an average trader, daily is recommended because of the free and easy availability of charts and data, less need for monitoring and no overtrading.

* Choose instruments that have high liquidity and high volume trading (like major currency pairs). The ones known to be regularly used by large institutional traders to build substantial positions are the best fit. (For related reading, see: Forex Currencies: The Four Major Pairs).

* Though going against the trend is tempting for many traders, it is better to follow trends for the inside day breakout trading strategy. Empirical evidence indicates higher success rates for going with the trend in anticipation of breakouts.

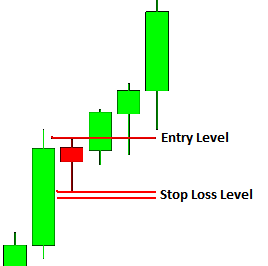

* It's advisable to make an entry for breakouts when momentum is high – i.e. a clear steep and strong move is visible, which can be determined by looking at lower frequency periods. For example, while following a daily inside day pattern, one can look for strong moves at 2, 3 or 4 hour intraday periods.

* To anticipate reversals, it is recommended to take a position opposite to the current trend.

* Inside day trading should be avoided during low liquidity periods. The corresponding patterns do form, but they are caused by low trading activity and not the desirable inherent factors of high accumulation and distribution.

Stop-lossesInside day strategy offers one of the simplest stop-loss mechanisms. It should one or a few, points below or above the inside bar level for a long or short position respectively. Forex traders use up to 5 pips below or above the bar levels for their stop-losses.

Profit Taking

Profit TakingThe point of effectively trading inside day is to enter long or short positions at lower levels in anticipation of a breakout (either from trend reversal or continued momentum). Compared to the previous day, the entry price is always better by the inherent nature of inside day bar. A tighter price range with each passing day ensures further favorable entry prices. Forex traders build models and strategies based on this concept.

As with any trading strategy, it is important to keep a target for taking profits. Inside day breakouts offer limited risk and high reward for breakout patterns. The risk-reward ratio for inside day trading pattern (1:3 and above) is higher compared to other trade strategies (1:2), indicating high profit potential.

Multiple inside bars can help traders build cumulative positions i.e. accumulating more positions each day based on a trader's criteria. Once the expected breakout occurs, the profit potential is significantly higher. The stop-loss level can be retained at that of the first day and while high reward can be accomplished with multiple inside bars. In fact, if followed in a disciplined manner, there is potential to cover multiple losing trades with one single profitable trade thanks to the better risk-reward ratio (1:3 and above).

The Bottom LineThe simplicity of inside day breakout patterns, combined with the high profit potential and lower underlying risk, makes it a very popular trading strategy. Forex is the most suitable trading asset because of its range-bound price patterns with frequent breakouts. Highly liquid stocks are also strong candidates for this strategy. Before trying this method out, traders should research carefully and backtest the pattern before finally choosing an asset to trade.