Any doji candle signals market indecision and the potential for a change in direction. (Always bear in mind that the “potential” for a change in direction is not a guaranteed change in direction.)

Doji’s are formed when the price of a currency pair opens and closes at virtually the same level within the timeframe of the chart on which the doji occurs. Even though there might have been quite a bit of price movement between the open and the close of the candle, the fact that the open and the close takes place at almost the exact same price is what indicates that the market has not been able to decide which way to take the pair…to the upside or the downside.

Let’s take a look at the doji highlighted on this 4 hour chart of the AUDCAD below…

Did You Know That There are Five Different Types of Doji Candlesticks?

At the point where the doji occurs, we can see that price has retraced a bit after a fairly strong move to the downside. If the doji represents the top of the retracement (which we do not know at the time of its forming) a trader could then interpret the indecision and potential change of direction and short the pair at the open of the next candle after the doji. The stop would be placed just above the upper wick of the doji. In this case, that trade would have worked out nicely.

Keeping in mind that the higher probability trades will be those that are taken in the direction of the longer term trends, when a doji occurs at the top of a retracement in a downtrend or the bottom of a retracement in an uptrend, the higher probability way to trade the doji is in the direction of the trend. In case of an uptrend the stop would go below the lower wick of the doji and in a downtrend the stop would go above the upper wick.

Dojis are popular and widely used in trading as they are one of the easier candles to identify and their wicks provide excellent guidelines regarding where a trader can place their stop.

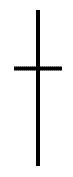

Below is an example of a standard doji candle.

The Long Legged Doji below simply has a greater extension of the vertical lines above and below the horizontal line. During the timeframe of the candle, price action dramatically moved up and down but closed at virtually the same level that it opened. This shows the indecision between the buyers and the sellers

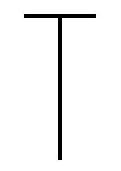

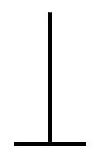

The Dragonfly Doji below can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. There is no line above the horizontal bar signifying that prices did not move above the opening price. A very extended lower wick on this doji at the bottom of a bearish move is a very bullish signal.

The Gravestone Doji below is the exact opposite of the dragonfly. It appears when price action opens and closes at the lower end of the trading range. After the open the buyers were able to push the price up but by the close they were not able to sustain the bullish momentum. At the top of a move to the upside, this is a bearish signal.

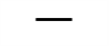

The 4 Price Doji below is simply a horizontal line with no vertical line above or below the horizontal. This would be the ultimate in indecision since the high, low, open and close (all four prices represented) by the candle were exactly the same. It is a very unique pattern signifying once again indecision or an extremely quiet market.

The basic rules we learned about trading a doji at the beginning of this article would apply to each of these unique dojis as well.