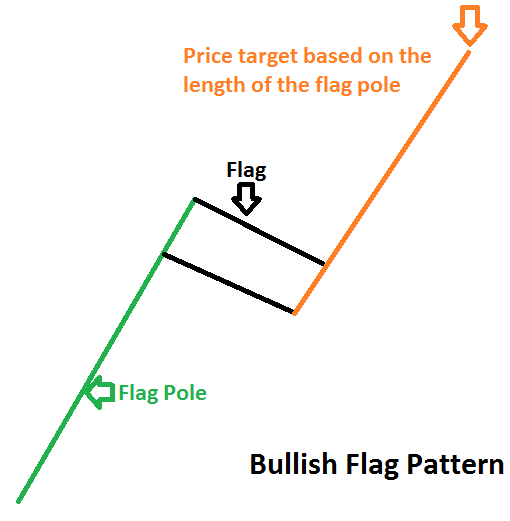

There are many different patterns that traders follow to help time entries and exits. The flag pattern is one that tends to catch my interest when I find it because they can provide explosive moves. The AUDCAD appears to be in the middle of a potential bull flag pattern. Today, we will look at how to identify higher probability trading opportunities off the bull flag pattern.

The flag pattern is fairly simple with just three components.

1. The flag pole

2. The flag

3. A strong up trend

First identify an instrument in a strong up trend (flag pole). Through the duration of this uptrend, eventually prices need to rest and consolidate those gains. This price consolidation becomes the ‘flag’ of the pattern. The flag portion of the pattern tends to be a gently downward sloping price channel.

Additionally, this consolidation will retrace a small portion of the previous up trend. If the retracement becomes deeper than 50%, it may not be a flag pattern. Ideally, we’ll see the retracement be less than 38%. Since this is a continuation pattern, we look for prices to break higher with a length equal to the size of the flag pole.

For the past 3 months, traders have been buying risk through commodities, the stock market, and risk based currencies. As a result, the Australian Dollar has performed well against most other currencies because it offers a higher interest rate of return. So we have a fundamental back drop for additional strength in the Australian Dollar. Today, we will match the AUD against the Canadian Dollar.

The AUD/CAD is no stranger to the flag pattern. Back in October 2011, we saw this pair form and complete a flag pattern as the Australian Dollar pushed higher in conjunction with the stock market bouncing higher.

Here is a picture of the completed pattern. The previous uptrend (flag pole) is noted in green. Prices consolidated in a gently down ward sloping price channel. This channel retraced only 38% of the previous up move. To trade the flag, you can time an entry at the lower end of the price channel or wait for a break up above the upper channel. Look to take profits by projecting the length of the flag pole at the bottom of the flag (orange dotted line).

If we fast forward to today, the AUD/CAD continues its march higher. Prices are currently consolidating sideways in a gently down ward sloping price channel. Therefore, we have an opportunity to enter into a trade with at least a 1:2 risk to reward ratio.

Look for an entry near the bottom of the black price channel as support to go long. Place a stop loss just below the swing low. So that means an entry near 1.0637 with a stop near 1.0590. Once prices reach the top of the black channel, look to move the stop loss to break even. If this pattern holds up, the AUD/CAD cross rate could move to 1.10.