Date: 21th November 2024.Gold Regains Momentum & NVIDIA Delivers a Revenue Surge!

Trading Leveraged Products is risky

*NVIDIA beat earnings expectations, and nearly doubled revenue on an annual basis.

*NVIDIA stocks dip slightly despite strong earnings and a strong forecast for the current quarter. Analysts expect market participants to purchase the dip.

*The Japanese Yen wins back some ground as Bank of Japan Governor indicates the regulator will be willing to hike to support the FX market.

*Gold, Silver and other Metals all rise due to predictions of high retail and institutional demand and geopolitical tensions remaining high.

NASDAQ – NVIDIA Surpasses Earnings Expectations!The NASDAQ took a sudden dip on Wednesday measuring 1.50%, however, investors quickly took the opportunity to purchase at the lower price as most indicators fell to give an oversold indication. As a result, the NASDAQ ended the day only slightly lower than the open price, but downward momentum remains this morning.

The downward momentum is partially due to geopolitical tensions which are on the rise. Yesterday, Ukraine fired UK-made missiles into Russia and fired US-made the day before. There are also reports and speculations that Russia has sent ICB Missiles into Ukraine for the first time. However, reports are not confirmed, and there are signs of certain stocks recovering.

Currently, there is no economic data which is driving the lack of demand, therefore investors are mainly concentrating on NVIDIA earnings. NVIDIA beat earnings expectations by 8.50% and revenue by 5.90%. Investors were particularly impressed by the significantly higher revenue which has almost doubled annually. In addition to this, the forecast given for the current quarter came in relatively strong. Lastly, the CEO, Jenson Huang, said to Bloomberg that demand exceeds supply but the company is setting in place measures to boost supply in order to meet the high level of demand.

Taking into consideration the strong earnings, positive tone and upbeat forecasts for the coming quarter, many may wonder, “why is the stock declining 2.50% during this morning’s Asian session?”. This is partially due to the lower risk appetite, but also due to certain forecast expectations for NVIDIA not being met. The average NVIDIA forecast expectations from Wall Street firms was $37.1 billion, which NVIDIA comfortably surpassed.

However, certain firms had expectations as high as $41 billion. Based on these higher expectations, the company underachieved and could trigger a lack of demand from this sector of Wall Street. Though many analysts continue to expect shareholders to purchase the lower price as long as the stock market will remain favorable.

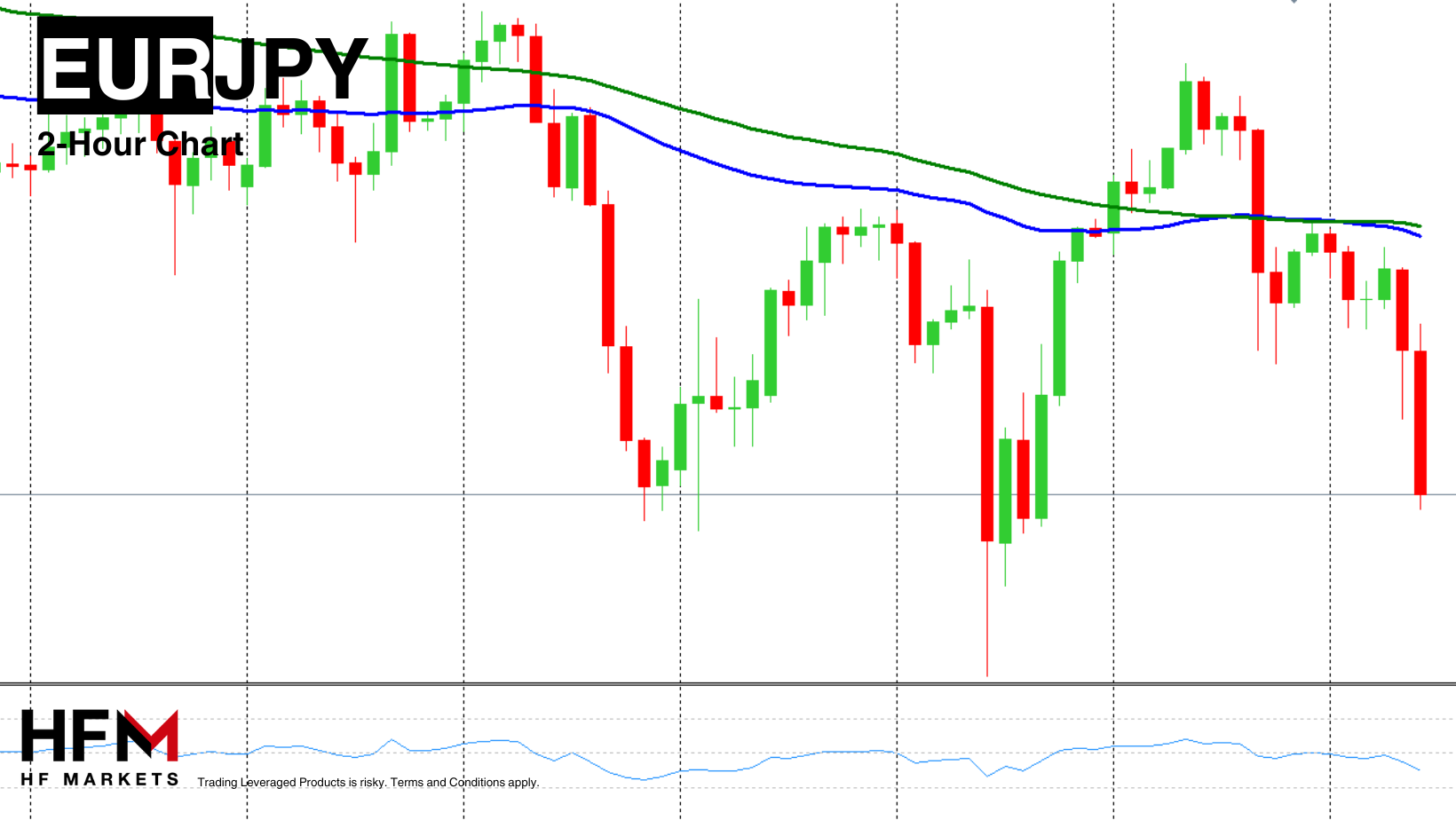

EURJPY – BOJ To Consider Hike!The EURJPY declines for a second consecutive day, particularly gaining bearish momentum after this morning’s Bank of Japan press conference. The main takeaway from the press conference was that the Governor told journalists that the BOJ was willing to hike interest rates in the upcoming months but decisions will be made meeting by meeting.

The Bank of Japan’s decision to raise interest rates in July was influenced in part by the weak Yen, which had driven up import costs and inflation. At the Europlace Financial Forum in Tokyo, Governor Kazuo Ueda emphasized that exchange-rate fluctuations are a key consideration in shaping economic and inflation forecasts. He noted that the central bank carefully examines what is driving these currency changes when assessing their impact.

The EURJPY now trades below the 75-Bar Exponential Moving Average and below the 50.00 on the RSI. In addition to this, the exchange rate continues to form lower swing lows while the Euro underperforms against most currencies. These indications point towards a potential downward price movement.

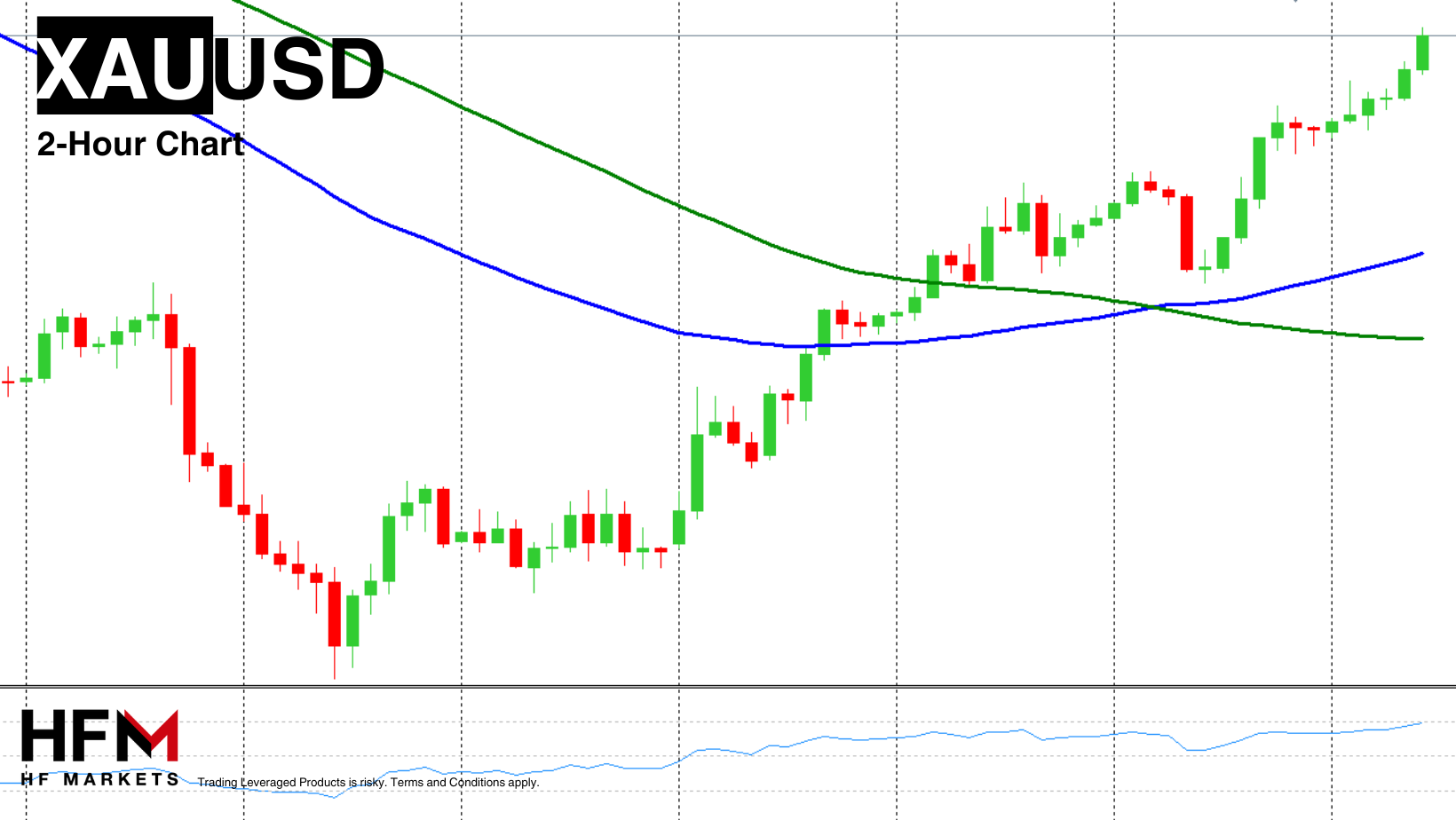

Gold – Geopolitical Tensions Send Gold on a Bullish Path!Gold has increased in value for a fourth consecutive day, driven largely by geopolitical tensions. Additionally, the absence of significant US economic news has left markets uncertain about the Federal Reserve’s next move. Gold is currently witnessing an active buy signal from most momentum-based indicators due to the strong bullish momentum.

For example, traders are able to see the price trading above the Bollinger Band, within a bullish moving average crossover and significantly high on most oscilators. However, investors should note as the price increases, the asset can become overbought and this may trigger a retracement, a correction or sideways price movement.

In terms of geopolitical tensions, hopes for a Middle East ceasefire are being tempered by Russia’s revision of its nuclear doctrine, which aims to strengthen its borders after the US-approved long-range strikes from Ukraine reached deep into Russian territory. Meanwhile, Donald Trump’s re-election has yet to significantly influence the conflict, though markets remain optimistic about potential positive developments following his January 20 inauguration.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click

HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding of how markets work. Click

HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.