Date: 25th October 2023.Market Update – October 25 – Stocks in Red; Dollar recovers.

Trading Leveraged Products is risky

Investors cheered the approval of a trillion-yuan sovereign issue as a harbinger of stimulus, while the Chinese government unveiled new support plans that include issuing additional sovereign debt and lifting the budget deficit ratio to finance fresh measures. Hong Kong reversed a pandemic-increase in stock trade levies and Chief Executive John Lee also announced a plan to halve taxes on home purchases for residents as well as non-residents. That helped to boost property stocks, even as troubled Chinese developer Country Garden Holdings Co. was deemed to be in default on a dollar bond for the first time.

*

*Stock markets got a boost from fresh stimulus measures for China. The Hang Seng has pared some of its early gains, but is still up 1.0%, while the CSI300 has lifted 0.6% and the JPN225 0.7%.

*European stocks: In the red today weighed by a flurry of bank results and a mixed batch of US Big Tech earnings ahead of the ECB decision tomorrow.

*Microsoft, Alphabet, and Visa reported their earnings, which indicated strong performance with revenue and net income growth in their respective quarters.

*Alphabet (-6% in after-hours) sales beat damped by cloud computing miss.

*Microsoft’s (+4% in after-hours) unexpected rebound in Azure cloud growth lifted shares.

*Snap Inc. also reported revenue growth but experienced operating and net losses in the same period.

*Santander net profit rose 20% on record-high interest rates.

FED: PMIs kept a Fed rate hike through the January 31 FOMC decision on the table with a 40% probability.

*USDIndex: returned above 106, but held sideways.

*AUDUSD: Aussie Dollar jumped after hotter-than-expected inflation lifted rate hike forecasts for the RBA next month, which would come after four rate pauses.

*USOIL steadied today at key 4-month support trendline after a 3-day sharp decline, amid signs that the Israel-Hamas war will remain contained for the time being at least. $83 is a key hurdle, which could indicate a move to $80.

*Gold holds gains above $1970.

*Bitcoin is up 15% this week amid speculation that ETF applications from BlackRock and others will succeed and drive capital into the asset class.

*Today: Germany IFO business climate, BOC rate decision, US new home sales and IBM, Meta earnings.

Interesting Mover: USDCAD

Interesting Mover: USDCAD broken the descending trendline from the draw tops of 1.3977 and 1.3861.

Andria Pichidi

Market Analyst

HFMarkets

Date: 26th October 2023.Market Update – October 26.Stocks and bonds were routed midweek. Tech shares were slammed after poor earnings news from Alphabet knocked its shares down nearly -10%, spreading gloom across the sector. A surge in Treasury yields added to the selloff. Meanwhile, ongoing signs of the strength in the economy after a pop in new home sales did not help. Instead, it added to expectations that a big jump in GDP on Thursday will keep a Fed rate hike in the picture later in the year or early 2024. That and fears over other big headwinds ahead added to a negative feedback loop that growth will slow sharply next year, further hurting investor sentiment.

*

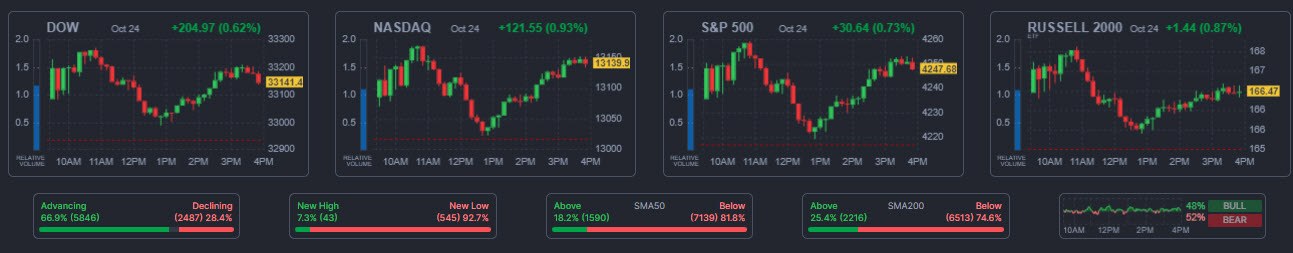

*Stock markets: The US100 crashed -2.43%, its worst slide since February. The US500 lost -1.43%, falling below the key 4200 level. The US30 slid -0.32%. The JPN225 underperformed and corrected -2.1, amid disappointing big tech earnings.

*Futures are lower across Europe and the US as markets wait for key central bank decisions, with the ECB kicking things off today.

*Alphabet shares logged their worst session since March 2020 overnight, dropping 9.5% as investors were disappointed with stalling growth in its cloud division.

*META fell 4% on Wednesday and another 3% in after-hours trade after publishing results showing better-than-expected revenue but a cloudy outlook, with expenses seen topping Wall Street estimates.

*USDJPY has broken back above the 150.00 mark, hitting 150.80 (highest since October) after finding courage to test the MoF again. The combination of expectations for more evidence of the strong US economy, including GDP, and the potential for another rate hike from the FOMC, are boosting the buck versus JPY, especially with still-fragile Japanese growth, along with rising expectations the BoJ will maintain its uber accommodative stance at its policy meeting next week.

*USDCAD rose to a high of 1.381 after the BOC’s announcement, the highest since early March and the SVB bank failure.

*USOIL recovered to $85 after a fall due to a rise in US crude stockpiles and a climb in US Dollar.

*Gold retests week’s resistance at $1988.

*Today: ECB meeting, US Durable Goods and Advanced GDP.

Interesting Mover: USDIndex

Interesting Mover: USDIndex got legs after the BoC left policy unchanged and downgraded its GDP forecasts.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click

HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click

HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.