Most new traders revel in leverage. They seek out brokers who provide high leverage, deposit a small amount of money and dream of the riches they will make. This is very delusional of course. But the subject of leverage seems to confuse a lot of professional traders and brokers alike.

Does Leverage Magnify Returns as Well as Losses?It is often said that leverage can increase your potential returns and your potential losses. What is often missed if that this is not a linear relationship. While you can increase your returns with more leverage, it comes a point when this is counter-productive. In other words, past point X, for 1 unit of risk you don’t get a 1 unit of return anymore.

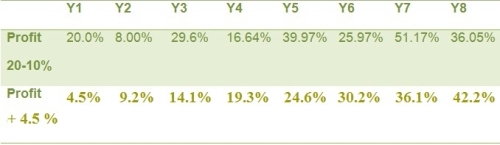

The Gremlins of Volatility This asymmetric return works in three ways. First, increasing leverage always increases the volatility of your trading returns. These are our first gremlins, the gremlins of volatility. Take a look at our first picture below. This simple table showcases two hypothetical systems A in the first column and system B in the column below it.

System A makes 20 percent one year but loses 10 percent the next. System B on the other hand consistently makes 4.5 percent each year. Obviously these types of predictable returns for either system A or B are impossible as markets don’t work that way. We use a simplified example here to prove a point.

Notice how after only eight years System A under-performs system B by 6.15 percentage points! You would think that the difference would be much smaller. After all, if we do a strictly arithmetical exercise, adding up +20% and then subtracting 10% leaves us with a net 10% after two years. Meanwhile the 4.5% system would make a net 9% (2X 4.5%).

The gremlins of volatility managed to ‘eat’ 6%, that’s over 1 year of returns. This is a huge difference and will only get bigger with time and increased leverage. The return variation between 20% and 10% is relatively small and yet it had profound effect on our results. What happens when newbie traders risk large percentages of their accounts hoping to get rich quick?

The Gremlins of DrawdownIt’s not uncommon for new traders to risk a large percentage of their trading capital. Large 50 percent (or more) drawdowns seem to be common among this crowd. Our second picture below demonstrates just how damaging this can be.

The first column shows the percentage of account drawdown. The second column shows the percentage increase needed to get back to break even. Notice how when the drawdowns are relatively small in the 10% range, the needed recovery percentages are trivial. But after a 50% drawdown one would need a 100% increase just to get back to square one. And the math gets progressively worse for the risk takers. After a 90% drawdown you would need a nine-fold increase in your trading capital to break even!

The Gremlins Eat Your Brain!But it’s not just the math that’s the problem. It’s human psychology as well. Many traders vastly overestimate their ability to take pain and drawdowns. A good exercise is to think about what’s the maximum drawdown you can take without deviating from your system or stopping trading altogether. Then HALVE this number.

That’s right, halve. If you think you can take a 50-60% drawdown, the actual DD in practice will probably be closer to the 25-30% range. I recently experienced this myself when I stopped trading a system at over 40% drawdown. Naturally right after I stopped the strategy made a miraculous recovery and ended up in the green just months later.

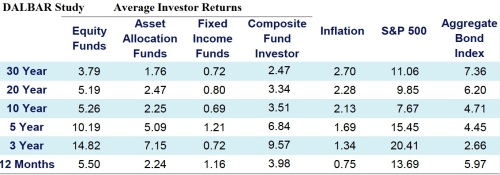

The picture above shows the famous DALBAR studies. It compares the returns of the typical investor versus the benchmarks, the SP500 and Barclays Bond Index in this case. Notice how both stock and bond investors under-perform their benchmarks and they do so in every timeframe, from one to twenty years. The study says:

‘’No evidence has been found to link predictably poor investment recommendations to average investor under-performance. Analysis of the under-performance shows that investor behavior is the number one cause, with fees being the second leading cause’’

This study is just one in a long line of similar studies. They all point to the same conclusion, investors under-perform because they fall victim to their monkey brain. For example, they sell stocks in panic right before they rebound. Or they chase the hottest stock. Humans in general tend to make bad decisions when it comes to money and even worse decisions when under pressure. Often times the reaction is to just throw your hands in the air and get out.

Conclusion What bigger pressure can you get then trading large size positions with little margin for error? Or trading in a large drawdown? Leverage only acts to magnify these basic human emotions and the errors they can cause.

In conclusion, trading on leverage is an asymmetric bet. While with increasing leverage the returns can be magnified somewhat, the risks tend to increase by a larger degree. Whenever possible traders should error on the side of caution. This road is slow and getting to your destination will take more time but at least you'll get there.