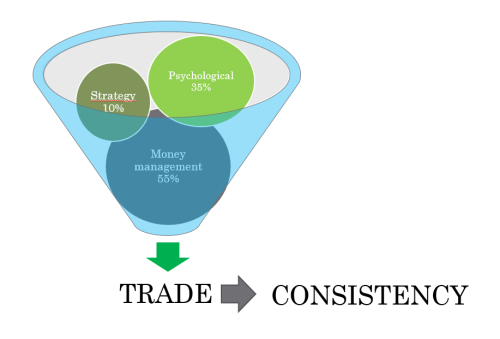

MONEY MANAGEMENT OR RISK MANAGEMENT is the way the investor or trader allocates its resources by observing the risk / return factors of the operations with the intention of becoming consistently profitable over time. It is the act of managing the capital in a conscious and disciplined way so that one obtains the greater profit by means of a smaller risk.

This is the most important point! More important than your strategy, because with risk management we can survive even with a bad strategy. Keep in mind that every strategy works as long as risk management is respected! But now if you have a bad strategy and risk management too, you will lose all the capital!

What are the risk factors?

• EXPOSURE OF CAPITAL;How much of your capital are you using in the market? How many lots and what volume are you assigning to your operations? How many parities do you operate at the same time? Are you diluting the risk between orders? Does your strategy use martingale or a grid?

This is one of the most important factors to be used and its non-compliance is what will determine how long you will last in the market and get consistent returns.

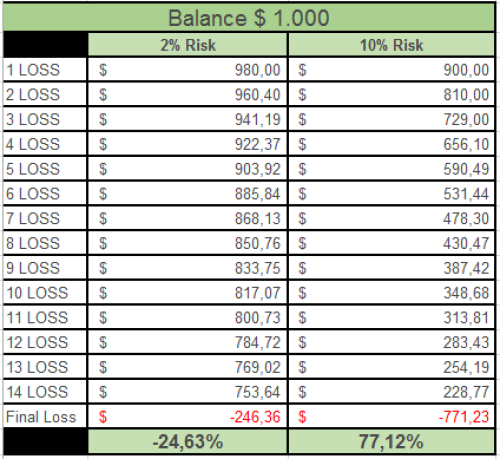

In order to limit the risk in each open position it is advisable to risk only 1-2% of your account value, at most 5%.

Beware: To recover the principal with the risk of 2% in the previous example the trader should make 32.7% and at 10% risk will have to make 337.3%.

Which risk do you think it is best to use? Taking a big risk means you can (will) lose your money quickly!

If you made a significant amount of money early on, make sure that big gains in the top positions mean big exposure at the end, so do not take risks until you have enough "fat" in your account. Risking profit is better than risking principal.

What good is it to make a profit of 500% in the first month and then lose all your money in the second month! This is not good!

Professional traders have consistent profits!

If you have good money management, in the months that there are losses, and this is normal and will happen, losses will be few and will not eliminate all the profit already achieved.

• LENGHT OF STAY;How long will your orders last? Are you day-trader? Swing Trader? How long does your order last in line with your strategy? Do you respect your stop loss?

The time you will keep an order will depend on the type of strategy used, but the longer you stay positioned the higher your exposure to high volatility events. If the market moves in your favor will be great but otherwise it is important that you respect your stop loss and do not believe that "the market will return", this lack of discipline will end your professional trader career.

• FREQUENCY;Do you open positions in the market at all times? Do you do trades on impulse? Do not follow your strategy by making other unplanned entries? Do you operate in times of high volatility?

Enter the market to try to pick up a few pips and if these entries are not part of your previously planned strategy, you are at too much risk!

No strategy has 100% correct entries, but you have a strategy with good entries and open trades on impulse at all times will put your capital at risk because it will be entries that you will have to manage without planning and can be caught In a time of high volatility and bad luck.

Remember: Luck helps those who have discipline!

All trades must follow a strategy and if you enter the market randomly or constantly change strategy and do not forego it before, you are still an inexperienced trader and will probably lose your capital.

Just do what your strategy tells you to do and you'll end up getting a trained mind to filter even false entries

But if you are not sure or you are in doubt: DO NOT DO TRADES! Preserve your capital and remember that luck privileges who is aligned with your strategy!

Otherwise, if you enter randomly or just to "risk" and the trade does not turn out as expected and you are leveraged, your psychological will sabotage you! IT'S FACT!

• PSYCHOLOGICAL;The most complicated risk factor to be understood is undoubtedly the psychological factor.

For capital management to be efficient the trader must have a strategy that is aligned with his psychological profile so that he is not "sabotaged" by his own mind.

There are thousands of acting strategies in the market, but the strategy that works for me may not produce the same results for you if we have different psychological profiles.

For example, a very anxious trader can not operate with long-term strategies because he will probably not tolerate an unfavorable order for a long time, it is likely that he will not end up respecting certain outputs.

Another example is the trader who has to make the results because he decided to live in the market and has "needs" to make 50% each month to be able to pay his bills. Unfortunately, this trader is a strong candidate for bankruptcy because your psychological will sabotage you at all times, being a very high risk factor for efficient capital management!

"Now I'm going to make it back!"

"It's now or never!!"

Unfortunately this will only sink you over and over ...

There is no doubt that the market generates expectations and often frustrations and the accumulation of these frustrations will cause the trader to sabotage at all times and lose discipline and that means not observing risk management.

Try to keep your psychological state stable, be tolerant of frustrations, and not have the obligation to get results because you need them to live! This will eliminate the "psychological" factor of your trades and will put you on the road to success!

STARTING TO HAVE CONSISTENT PROFITS

Every trader must understand that the main tool that will make you profitable in the long term and consistently is how it will manage your capital, there is no HOLY GRAAL in investments what there is is a disciplined job by the operator!

If the trader starts to understand and apply these concepts he will become a professional trader and he will start to reap good results!

DO NOT FORGET, KNOWLEDGE TRAINING AND DISCIPLINE IS FUNDAMENTAL FOR WHOM YOU WANT GOOD PROFITS!