Scalping strategies. Scalping strategies are based on the principle that we need to maximize more profits from the Forex market for a minimum period. In trading in this strategy, even a certain portion of the time is taken as a result of 1 and 2. Trading is mainly undertaken in 1 minute, 5 minutes, 15 minutes, 30 minutes and rarely 1 hour time-frames. Scalping trader should have solid nerves and in no case should turn off the rules of the chosen strategy. As for profit, these strategies are of prime importance. Let's assume you take only 10 points per day. Standard lot eur / usd (euro / dollar) The cost of 1 lot is 10 USD, therefore 10 points are 100 dollars. 100 dollars a day, you agree with a good result, but ... there are many but who do not take 100 dollars a day but we will lose it.

" Financial markets are known for a lot of scalping strategies that are successfully used by forex traders."

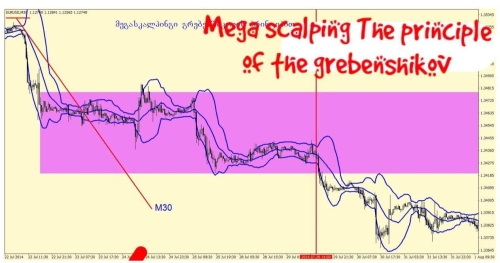

" Mega scalping with the principle This strategy of Forex is described by the well-known trader, Stanislav Grebenshikov's book "Форекс и мы". It is a very interesting and effective strategy. "

1. Foreign exchange pairs: EUR / USD; Half Freemium: M30 (though it is permissible for larger intervals, but in this case, this strategy can not be called classic scalping); On the diagram we set the indicator Bollinger Bands with standard parameters: Period - 20, Deviation - 2, Used to close, Prev - 0.

Market entry principles:

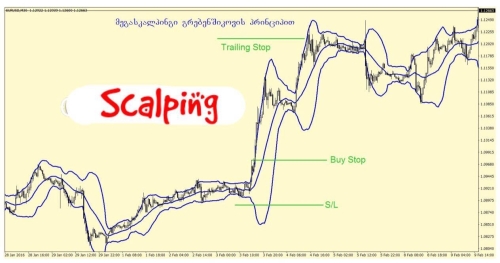

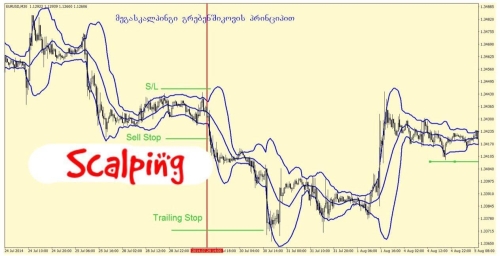

1. If the indicator Bollinger Bands creates parallel lines, then we put the shaded orders on the top of the horizontal channel and below 20 points + sprint loft;

2. At the same time, we analyze the D1 schedule, if we notice that we are at the boundary of the channel, then we have only one concluded order at the border of this Bollinger Channel

Figure 1. The D1 graph shows that the price is indicated by the Bollinger Bands on the lower border with the lamp rectangle.

"vStop the Stop Loss at the Bollinger Bands Indicator's Horizontal Channel Border within 20 Points + Spread "

If the market is not such a situation and the price on the D1 diagram is between Bollinger Bands indicator boundaries, then we will use the classical method and we've placed the conveyed orders at the boundaries of the 20 + Spread point.

Situation development scenarios:

1. In all the options we will take a position at the point of 25 points of profit;

2. If a warrant is started and the price will go against us and hit Stops, ie, the trend is in the opposite direction, then the first order will be closed down and the second order will be started. In this case, if we win 25 points, we will stop the stop losity in zero, ie in the zero, ie, the price of opening the order and the position with a 20 point point;

3. The strategy envisages opening of additional orders, receiving the corresponding signal only if the warrants / warrants already opened are placed in the position of the latter;

4. The position closes only with stop loses and trailing stop stop;

5. Bollinger Bands Indicator's blog breaks and afterwards, additional positions will be opened only in the direction of the trend; Buying an example.

An example of selling.

"Several strategies, which have been effectively used for forex for years.

To understand these strategies, we need to know some technical term."

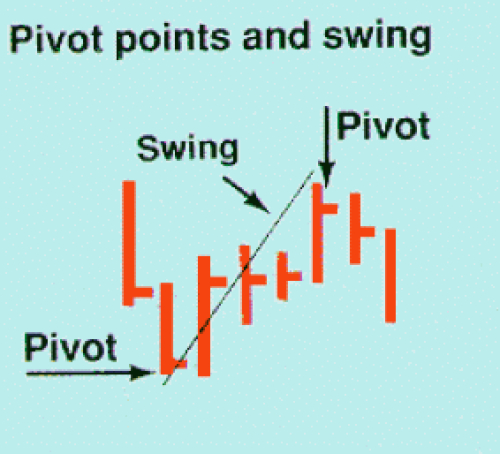

"Key point" - pivot point. Is the maximum or minimum point that the price has reached until the day maximum or minimum of the day;

"Swing" - Swing. There is a rigid movement from one key point to the pivot point, the second after the key point. (See example at Figure 1);

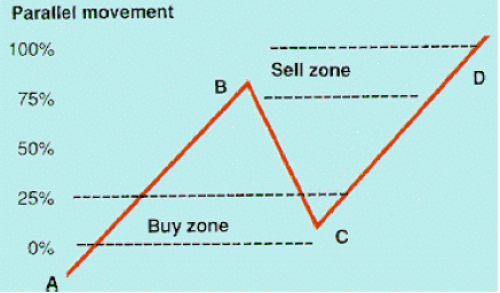

Scalpel strategy of parallel movement:

The graphical example of the parallel motion scalpel strategy is presented in Figure 2. This method is used when the length of the price above or below the price is reverse.

The main tactic of trade is based on the idea that the distance to the drive is equal to the distance of the drive. The positions are more profitable when the order is opened at the moment when the price has not yet passed 25% of the distance between C and D points.

We're going to buy a price when the price has gone up from the key point of the S to 25% and we'll immediately stop at the bottom of the C point.

Stops loose in loser when the price has reached 50% of target target

When the price goes through the point point we set the trailing stop, whose parameter must be 25% of the distance to the target target.

The position closes at the profit D point, or is waiting for its closure with trailing stop.

The strategy is recommended for trading in the direction of trading. There is no need to hunt for minor anti-trail motions. Strategy aims to catch up with the total movement of the price. It is quite possible that by using this strategy, enter the market for a period of one working / trading period, especially if Audley has a difficult consolidation.

,,