Trading in ranging or congested periods in the market can prove challenging for a number of reasons; and because of this many traders choose to wait for prices to breakout before looking to initiate a position.

This article will walk through one of the more common congestion patterns in use by price action traders: The Triangle; as well as possible ways that traders can look to play this pattern.

What is a triangle?A triangle is a period of activity in which prices form what literally appears to be a triangle, or wedge on the chart. The below picture will illustrate a ‘descending triangle:’

Created with Marketscope/Trading Station

As you can see, the currency pair is in the process of making lower highs and lower lows; but it has not yet been able to decisively break through previously established support.

This tightening range of prices can offer a potential setup to the price action trader. Before we get into how to plot trades on triangles, let’s take a look at another flavor of the triangle formation.

Created with Marketscope/Trading Station

How to trade Ascending/Descending trianglesThe most common way of playing triangles is to look for breakouts as either support or resistance is being broken. With the Ascending or Descending Triangle the trader has luxury of a strong element of support and/or resistance to utilize. Let’s take a look at the same descending triangle we looked at a moment ago:

Created with Marketscope/Trading Station

As the currency pair is making lower highs while buckling up to a strong support line, traders can get the idea that the weakness in the pair isn’t quite great enough to break through, but at some point, may be able to. And if price momentum is strong enough to break through support, price may be able to continue to run.

So many traders will go into a Descending triangle as we see above with a bearish stance, looking to enter the trade once support can become broken. This can be done by placing an entry order to go short below support.

For Ascending Triangles, the trader can look to a bullish bias as higher lows have been unable to break through resistance. The trader can look to enter by placing an entry order to go long above resistance.

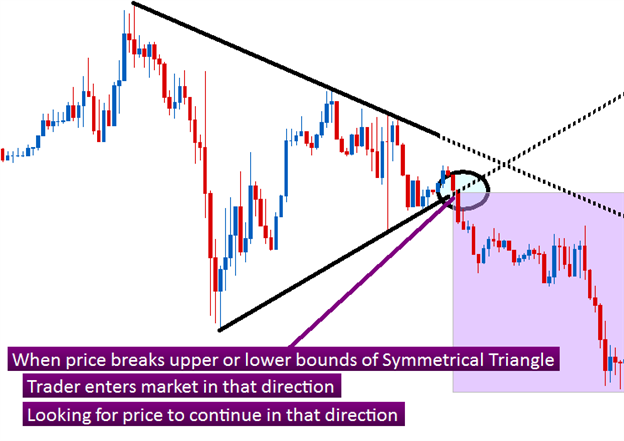

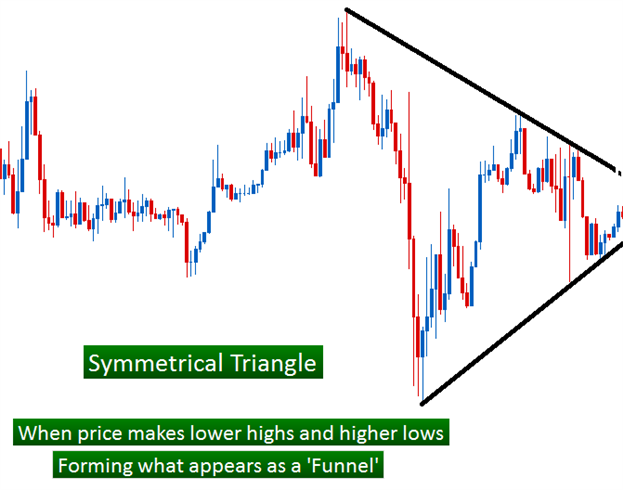

Symmetrical Triangles are a little different as a strong element of static support and/or resistance isn’t available in the same way as it might be with an ascending or descending triangle.

With a symettrical triangle, because price action is narrowing by making both higher lows and lower highs, traders might be unsure of which direction a possible breakout may occur.

As such, it may be more prudent to wait until the break of support or resistance takes place; and then looking to trade the pair in that direction.