I like to think of myself as a risk manger first and a trader second. This ensures that I never forget the importance of a stop-loss when entering any trading position.

If you think that how you manage risk will, in part, define how you succeed in trading, you already understand the importance of limiting your trading losses.

You have the discipline to not only set your stop-loss but also respect it when price is dangerously close to ending your trade.

Stop-Loss Is Unique

Most traders understand market orders and limit orders but a protective stop order is unique. You set a stop-loss to manage the amount risked on a trade but sometimes your risk parameters are exceeded.

Here Is How A Stop Order Works In The Market:* Stop-losses are sitting in the market as limit orders waiting to be filled

* When triggered, your stop turns into a market order

* Market orders are filled at the best price available

* A runaway market can have your stop price filled at a worse price than you originally intended.

This is called slippage and for many traders, it is not a risk that is thought about nor accounted for in their trade plans. You never know when slippage can occur (remember it can also happen on entry into the market as well) and it is something that is difficult to plan for.

It’s a risk that is present when volatility enters the market (or in markets that lack liquidity) and I’ve really only seen it be an issue for me when I thought I could trade the news releases.

One frustrating issue for many traders is when your protective stop gets triggered and then price continues back in the direction of your just exited trade. The market is an order filling machine and when stops are triggered it causes order flow which, depending on which side of the fence you’re one, is a good or bad thing.

For big players, triggered stops allow them to exit and enter positions with little slippage because the volume is there to support it.

For smaller players, these locations do allow you to not only get a good price, but also ride the wave caused by the bigger positions at play.

For those stopped out, it’s a frustrating and account churning process.

Stop-Loss Placement

To protect your account, you need a stop in the market.

The question becomes “where do you place it”?

Stop-Loss Areas* Use an average of the prices such as a 20 period moving average

* Place it around trend lines

* Place it on the opposite side of support or resistance

* Use market structure

There are some drawbacks to each of these methods:1 A moving average is simply an average of previous price. There is not really an edge in using it.

2 Trend lines can be subjective at the best of times and while they can measure the rhythm of the market, it’s just a line.

3 Support and resistance are very popular places for stops which makes them prime targets for stop runs.

4 Market structure can be used especially if you use a location where the trade would be invalidated.

There is no perfect location but whichever you choose, ensure you are consistent in their usage and place your stop just outside of the noise of the market.

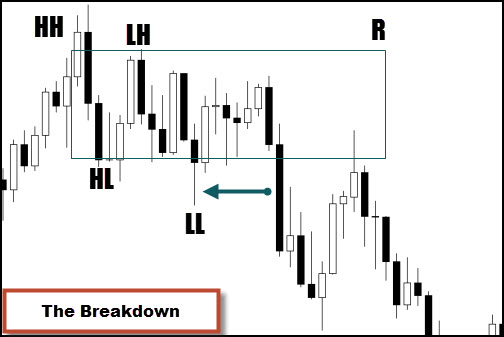

Structure Based Protective StopThink of price action as the pen and structure as what the pen draws. Price moves in waves and leaves traces of where it’s been.

In an up trending market, we have price making higher swing lows and higher swing highs.

As long as this pattern is intact, we can expect our trades to be relatively safe. Even if the highs start getting lower, it’s not a sure thing that the move is completed and it may even be an opportunity to buy into this market.

Once the lows get broken, then we have an issue. This chart is a continuation of the one just above.

You can see where the bulls were running out of steam with the higher high (HH) but once the lower low (LL) was printed, buying resumes although temporarily.

Price is in a range (R) and with one large bear candle, the bottom is shattered.

I want to draw your attention to the arrow. The candle where bulls stepped in is an obvious reversal candle – a swing point – and where did the buyers place their stops? Just below it and the size of that momentum bear candle indicates that those stops were taken out.

One main point is that this particular chart is after a long run up in price. Buying (or selling) after such a large move is a risky venture as those who bought in at the bottom look to take their profits.

The Stop RunThat chart showed that the structure low was a great spot to place your stop as price continues to fall after the retest. Many times though, the next chart shows what happens.

Where the dotted lines start on the left, we can see price dropped as sellers stepped into the market. Following the textbooks, many of the shorts probably have their stop just above the pivot thinking that if it is violated, it’s the end of the move.

Price pulls back, runs the stops to the red line and on the same candle, the sellers stepped in and drove the market down.

The Stop-Losses Were Inside The Noise Of The Market.Small pierces of support/resistance do not indicate the move is invalid and if you scroll through many charts, you will see this play out time and time again. The problem is that most traders want a tight stop which will allow them to increase their position size.

This desire also puts them in the line of fire with stop runs. Yes you want your stop around the pivot area but also far enough away that these runs won’t hurt you.

You will still risk the same on the trade it’s just that you will have to live with a smaller position size.

Is it foolproof?

No and as we had seen in a previous chart, when the pivots break, the move continues in that direction. You still are not risking more by having your stop outside the normal fluctuations of the market and you may increase your chance of staying in when many are taken out.

Define The Loss & Protect Your Account1 When a potential trade lines up, where is your stop going to go? Outside a pivot or range high/low AND adjust for the noise of the market.

2 Define your dollar risk on the trade and calculate the number of contracts you can afford according to your defined risk amount.

3 Enter the trade and ensure that your stop-loss is in play.

4 Allow the stop to execute when adverse price action takes place.

Your stop-loss is your friend that is meant to save your account from destruction. Let it do its job by ensuring you place one on every trade and as you can see, it is not difficult to define the location. Just remember to account for the noise and stay within your risk tolerance.