1. SummaryWith this article I intend to continue the study of the renko chart that I started in my previous article (Renko charts on the Jforex platform) so that traders and operators can increasingly incorporate the use of this powerful price action tool into their daily lives.

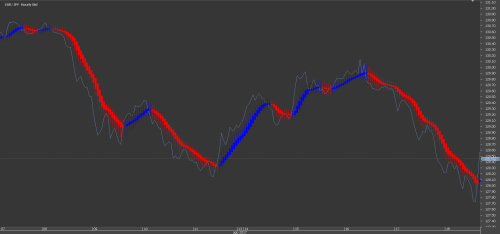

In the previous article we learned how to put and configure renko on the Jforex platform and I put a basic strategy to understand its operation, its operational logic (bottom failure, top failure, price level breach). Understanding this logic is key to knowing how to operate a renko chart.

Now we will go further and deepen our studies and we will use some more advanced understandings for the use of more specific indicators and also the introduction of "Heikin Ashi smoothed" - That's why I call this setup "Renko Ashi".

He whose ranks are united in purpose will be victorius - Steve Nison

2. Renko chart and Heikin ashi* To continue with the studies we will first make some definitions:

"Heikin Ashi": are candles charts that have a different form of calculation for their formation, eliminating the noise of a normal candle in time.

Heikin-Ashi Candle Calculations

HA_Close = (Open + High + Low + Close) / 4

HA_Open = (previous HA_Open + previous HA_Close) / 2

HA_Low = minimum of Low, HA_Open, and HA_Close

HA_High = maximum of High, HA_Open, and HA_Close

* "Heikin Ashi smoothed": the difference from this version of heiken lies in the fact that it is built based on a moving average and makes it better to find a trend that starts.

Open_1 = EMA_1(Open)

High_1 = EMA_1(High)

Low_1 = EMA_1(Low)

Close_1 = EMA_1(Close)

haClose = (Open_1 + High_1 + Low_1 + Close_1) / 4.

haOpen = (haOpen(previous bar) + haClose(previous bar)) / 2

haHigh = max(High_1, haOpen)

haLow = min(Low_1, haOpen)

Open_2 = LWMA_2(haOpen)

Hight_2 = LWMA_2(haHigh)

Low_2 = LWMA_2(haLow)

Close_2=LWMA_2(haClose)

For our advanced strategy we will use the heikin ashi smoothed together with the renko chart and the purpose is only one: We will look for a trend (heikin smoothed) and enter it with greater precision (renko chart).

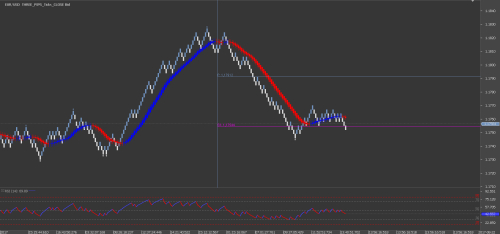

3. Configuring and assembling the templateAs stated above, the main goal of this strategy is to find a trend and get into it at the right time. With the right indicators and correct calibration, we can have more reliable and more assertive inputs. The stop loss and take profit are delimited with greater security, because in every trade we must always seek the highest possible return with the delimitation of the loss in the correct place that does not disturb and take us out of the trade in advance.

3.1 – Indicators to be used and their settings:

* renko chart 3 pips (Please see the link in the bibliography if you still do not know how to configure renko);

* Heikin Ashi smoothed ( MA type SMA, period 2 – Secondary MA type LWMA, period 22);

* RSI: Close price, period 14;

* Fractal (22 bars);

* Pivot Points;

* Coloring rule (follow the colors of the figure).

4. “Renko Ashi - Strategy

Every novice trader usually looks for scalping strategies or short shots in the hope of making big bucks quickly and staying millionaire, with the experience gained over the years they will realize that making quick money in this market is a very difficult task, since the use of Leverage can (and believe me, it will) go against you ruthlessly and cruelly. So I believe that these quick-entry strategies should only be used by anyone who knows what they are doing, in other words, experienced traders!

The strategy I will demonstrate is called "advanced" because it brings concepts of using the indicators and tools more complex, but it will greatly help the trader to have a correct and classic view of technical analysis.

It is a "day trade" strategy, to open and close the order on the same day, seeking a greater quantity of pips possible within the day.

It is used preferentially in favor of the trend, but provides excellent inputs in times of market exhaustion and correction, thanks to the set of indicators used.

So let's see how to use it?

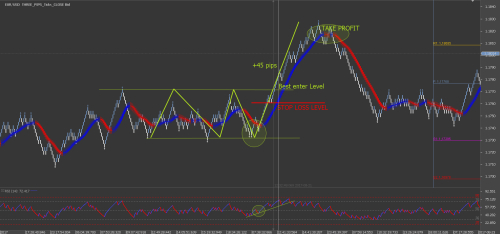

4.1 Buy signals

The chart above shows perfectly all the features required for a perfect buy entry. Let's explain:

* bottom fail in renko chart;

* Heikin ashi smoothed blue and his body getting without the trace below (strong signal);

* RSI above the 50's line and making bottom ever higher;

* Price breaking previous tops (price and fractals);

* Renko made a higher bottom and above the heikin and broke top;

* Take profit: Reikin ashi reverse the signal (red);

* Stop Loss: Prior bottom to entry.

Note that within the range appear some small entries, but not all requirements have been met to authorize them mainly heikin ashi that has risks above and below the body!

TIP: Never enter the first price-break attempt, expect confirmation if the market breaks at first, it's best if it goes without you!

The pivot points will always provide us with a support and resistance area and this gives us an idea of target, since the price always tends to go get those points.

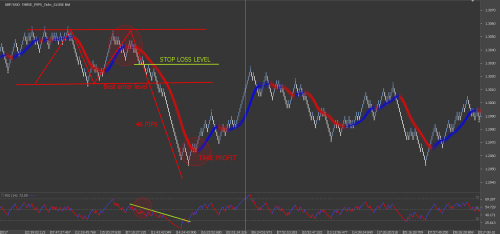

4.2.Sell signals

The chart perfectly shows all the features needed for a perfect short entry. Let's explain:

* Top fail in renko chart;

* Heikin ashi smoothed red and his body getting without the trace above (strong signal);

* RSI below the line of 50 and making lower and lower tops;

* Price breaking previous bottom (price and fractals);

* Renko made the top lower and below the heikin and broke;

* Take profit: Reikin ashi reverse signal (blue);

* Stop Loss: top before entry.

4.3.Input signals against trends (end of trend or start of correction)

This setup also provides us with a good insight to identify an end of movement and beginning of a stronger correction. See the figure:

In order to identify the end of a movement with this strategy, it is enough to note the following divergence between the price and the RSI indicator:

Selling Depletion: The price makes a bottom, soon after it makes a lower bottom, but the RSI shows divergence and in the second price bottom the indicator makes a bottom higher than the previous. This is the so-called "golden entrance".

The divergence of the RSI is one of the strongest signs of entry, both for sell and buy, as it clearly demonstrates reversal or correction.

5. ConclusionThe use of this "renko ashi" template is a great tool for the trader, especially for the beginner, who has a harder time seeing what is happening on the chart.

Many traders do not adapt to the renko chart, but we need to know that when we put momentum indicators like the RSI, they become much more assertive because the indicators will be plotting information based on pure price, avoiding errors and getting more precise!

Keep in mind that every strategy does not go it alone if the trader does not use careful capital management, this is crucial!

Good trades to all!